Volatility is rising in Thailand’s financial markets amid concern investors will have to wait until August to find out whether a coalition of pro-democracy parties can form a new government.

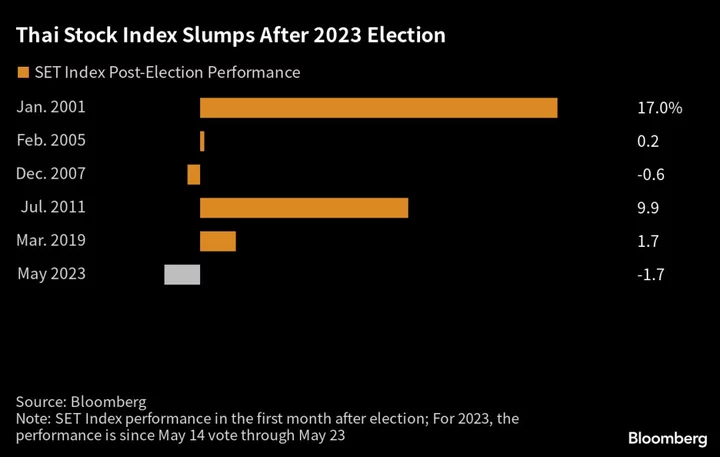

Uncertainty after the May 14 election first triggered an outflow of funds, worsening the rout in Asia’s worst-performing stock market this year and weakening the baht. Stocks then rallied this week, and the currency retraced some of its losses Wednesday.

While the new coalition formalized its alliance Monday, when a quarterly economic report showed better-than-expected growth, there is concern that funds will keep taking money out of the country until there’s clarity on the new leadership.

“This is a classic case of politics getting in the way of an economic rebound in the making, which would certainly have been bullish for Thai assets,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore.

Overseas investors unloaded the nation’s bonds for a fifth day on Tuesday, with outflows totaling more than $1.2 billion over the period. They’ve sold off stocks for 11 straight days, withdrawing $725 million, according to data compiled by Bloomberg. The benchmark SET slid 3% last week before rising 1.7% over the past three days.

Thailand’s Election Commission has up to 60 days after the vote to release official election results and certify 95% of the lower house seats. The first session of the new parliament must then take place within 15 days. That pushes back the timeline of government formation to late July or even early August.

The coalition forged by the Move Forward Party, which won the most seats in the election with 313, a clear majority in the 500-member House of Representatives. But as things stand, that’s still short of the 376 needed for Pita to become prime minister. He will require broader support from the military-appointed Senate, whose 250 members also vote on who will get the top job.

‘Serious Question’

“The rising political risk post election has really unnerved investors, with foreign outflows from Thai bonds and equities,” said Kobsidthi Silpachai, head of Capital Market Research at Kasikornbank Pcl in Bangkok. “There’s a serious question from investors about when the new government will be formed. Any delay would significantly affect the economy.”

Should the coalition manage to form a government, the parties are expected to follow through with their promises of giving cash handouts, increasing the minimum wage and boosting allowances for pensioners and the elderly. The Move Forward Party has also pledged to end business monopolies and promote more investment outside of Bangkok.

Read: Here’s How Thailand’s PM Race Could Play Out as Talks Drag On

“We still expect the SET Index to move sideway until the parliament’s session to vote on the prime minister,” said Padon Vannarat, head of research at Yuanta Securities Pcl. “We have to watch the senators’ directions closely but we expect the index to rebound, especially when the parliament’s vote for a new PM gets closer.”

--With assistance from Ishika Mookerjee.

Author: Karl Lester M. Yap and Anuchit Nguyen