UK property surveyors turned more positive about the outlook for house prices despite soaring interest rates that they expect will hurt the ability of buyers to afford purchases.

The Royal Institution for Chartered Surveyors said its measures tracking new buyer inquiries, prices and expectations for where the market is heading all were less negative in May than in previous months.

The group, which collects the views of people who evaluate property as it’s put up for sale, reiterated its warning that a jump in mortgage interest rates is likely to constrain the market in the months ahead. But for now, its report was less gloomy than previous readings.

“Storm clouds are gathered,” Tarrant Parsons, senior economist at RICS, said in a report released Thursday. He said “stubbornly high inflation” is likely to trigger more interest rate increases, “leading to higher mortgage rates and ultimately reducing affordability and buyer demand.”

New buyer inquiries registered minus 18% in May, according to RICS, the least negative reading in a year. Its measure of house prices rose to minus 30%, the third consecutive increase and up from minus 46% in February.

When asked about the outlook for prices over the next year, surveyors were broadly neutral, boosting that index to minus 3% last month from minus 16% in April.

“House prices seem to be holding up despite a challenging economic climate,” Martin Davies from Countrywide Surveying Services said in the report. “Demand is still outstripping supply so houses are still generally selling quickly after coming on the market. However, purchasers are more cautious on price.”

The survey contrasts with reports from mortgage lenders Nationwide Building Society and Halifax, each of which have showed house prices starting to fall again after strength earlier in the year. Their reports are based on transactions completed, while RICS is based on sentiment of people looking at properties that have just come to the market.

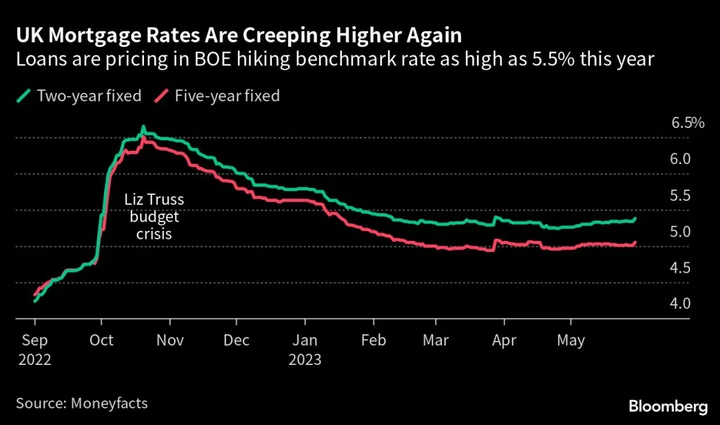

Mortgage rates have headed higher in the past few weeks after higher-than-expected inflation prompted investors to bet the central bank will keep hiking rates through this summer.

Rates on the the most popular loans are now above 5%, a level the BOE has identified as a pain threshold for consumers. The average cost of a five-year fixed deal with a 85% loan-to-value jumped to 5.02% this week, up from 4.55% the previous week, according to the property search website Rightmove.

RICS said those factors are likely to weigh on the market in the months ahead, even if surveyors have for the moment turned a little less pessimistic.

“The banking sector appears to expect this with many banks and building societies already introducing products with higher interest rates,” Parsons said.

Some economists have warned that property prices could slump by 10% this year, though a lack of supply and a robust labor market is providing some support. Halifax said prices were unchanged in the month of May and fell 0.4% in April.

“The sales market over the last month resembles Wile E. Coyote in the Roadrunner Cartoon — sprinting in mid air and oblivious to the pending downforce of gravity,” said Neil Foster at Hadrian Property Partners in Hexham. “The cost of debt has subdued demand, and, sadly, many estate agents are too willing to embrace vendors delusion on price.”

RICS’s report suggested more houses are coming to market. Its measure of new instructions to sell property rose to a balance of 14% — the strongest since March 2021 and a break from a run of 13 consecutive negative readings. The number of properties the average surveyor has listed for sale rose slightly to 38 — still below the average of 40 over the past five years.

The “property market continues to tick over as we move into summer period,” said Melfyn Williams of Williams and Goodwin — The Property People Ltd. “The right property, in the right location, at the right price is selling well.”

Read more:

- Halifax Says UK House Prices in First Annual Drop Since 2012

- UK House Prices Resume Decline With Warning of Headwinds

- UK Construction Firms Slash Housebuilding as Loan Rates Jump

- UK’s Stubbornly High Inflation Fuels Bets for Higher Rates

(Update with surveyor quotes)