British home prices fell further last month as borrowing costs held back demand, one of the largest mortgage lenders said, although the rate of decline showed a chance that the market could yet avoid a hard landing.

The Nationwide Building Society said prices fell 3.8% in its July survey from a year ago, quicker than a 3.5% drop in the previous month. While economists expected a slightly larger decline of 4%, it was the third straight month that prices had fallen at their fastest pace since the global financial crisis in 2009.

The first hard data about July home prices indicate the 13 interest-rate increases from the Bank of England since the end of 2021 have strained consumer’s ability to pay for properties. Values based on Nationwide’s data have fallen about 4.5% since they peaked in August and now average £260,828 ($334,000).

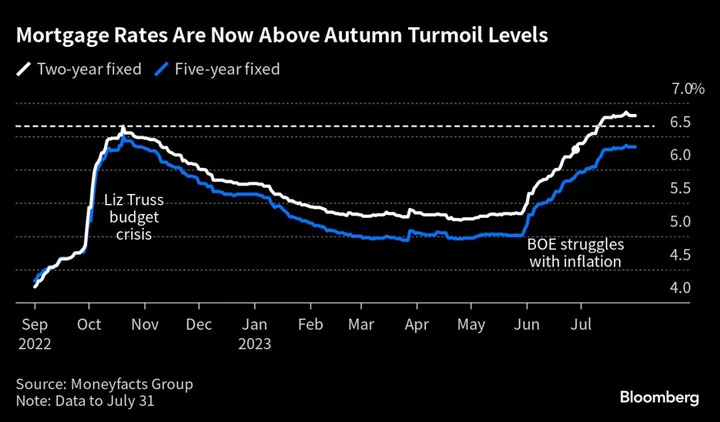

Still, prices have so far avoided the collapse that appeared possible last autumn, when then-Prime Minister Liz Truss’s ill-fated budget sent borrowing costs soaring to 14-year highs. In November, Nationwide warned of a potential 30% drop in prices in a worst-case scenario.

Nationwide’s chief economist, Robert Gardner, said on Tuesday that a “relatively soft landing is still achievable” while another economist for the lender said that it was now forecasting a peak-to-trough decline of around 6.5%.

“We’re expecting modest falls over the rest of the year,” Senior Nationwide Economist Andrew Harvey told Bloomberg Radio Tuesday. Prices fell 0.2% from June to July, after a 0.1% gain the previous month.

Bloomberg Economics, however, reaffirmed its forecast for a peak-to-trough decline of around 10% on Tuesday, implying they have a further 5.5% to lose. Mortgage rates and a cost-of-living squeeze will weigh heavily on property prices, and home prices remain overvalued when compared with incomes.

What Bloomberg Economics Says...

Britain’s housing market correction has further to run. While the latest UK Nationwide house price index was less bleak than expected, borrowing costs are set to remain elevated. That means an adjustment in house prices is likely to continue despite some resilience recently.

-Niraj Shah, Bloomberg Economics. Click for the REACT.

Nationwide said there were 86,000 completed housing transactions in June, which is 15% below the levels prevailing a year ago and about 10% below pre-pandemic levels. Housebuilders have scaled back on projects anticipating fewer buyers.

Building supplies company Travis Perkins Plc reported lower revenues and a 31% drop in adjusted operating profit, amid “significant weakness” in the UK’s housing sector. The FTSE 250 business said Tuesday that it had suffered during the first half of the year from a “notable reduction in housing transactions” as interest rates climbed.

“There’s a lot of uncertainty among people looking to purchase a new home, so it’s no surprise prices continued to edge down on both a monthly and annual basis in July,” said Nicola Schutrups, managing director at Southampton-based mortgage broker The Mortgage Hut. “Further falls in house prices are likely for the rest of 2023.”

Rate Increases

Economists are anticipating that the BOE will hike rates by another quarter-point to 5.25% on Thursday, which would be the highest since 2008. Traders meanwhile are pricing in a 40% chance of a half-point rise this week, with rates seen approaching 6% by February.

Nationwide estimated that people earning the average wage and seeking a typical first-time buyer property with a 20% deposit would see monthly mortgage payments account for 43% of their take home pay at a 6% mortgage rate, up from 32% a year ago.

“While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks,” Gardner said.

--With assistance from Andrew Atkinson, Julian Harris, Caroline Hepker and Stephen Carroll.

(Updates with Bloomberg Economics forecast in eighth paragraph.)