UK house builders cut back on developments at a pace last seen during the pandemic and the global financial crisis 14 years ago after a jump in mortgage rates, a closely watched survey found.

S&P Global said its PMI index for the sector dropped to 42.7, the lowest since May 2020 when homebuilding was brought to a standstill by the first Covid-19 lockdown. Excluding the pandemic, it was the weakest since 2009.

It bucked a wider pickup in the construction industry in May. The overall PMI rose to 51.6 from 51.1 in April, boosted by commercial building and civil engineering work. It was stronger than the 50.8 forecast by economists, with any reading above 50 signaling growth.

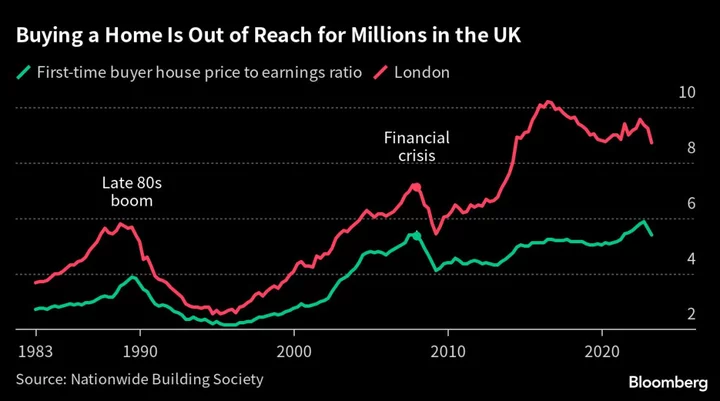

However, the drop in housing activity is the clearest sign yet that developers are responding to a weaker property market by scaling back projects. Nationwide Building Society said last week that UK house prices fell at their fastest pace in 14 years in May as rising interest rates cooled buyer demand.

The downturn is thwarting government efforts to increase the supply of homes as younger generations are priced out of the market after a decades-long housing boom.

“Cutbacks to new residential building projects in response to rising interest rates and subdued housing market conditions resulted in the sharpest drop in housing activity for three years,” said Tim Moore, economics director at S&P Global Market Intelligence.

“This meant that residential work underperformed the rest of the construction sector by the greatest margin since October 2008.”

Mortgage rates, which had been easing after hitting 14-year highs last autumn in the wake of former Prime Minister Liz Truss’s radical economic program, have started to climb again as investors bet on the Bank of England continuing to increase interest rates to stamp out sticky inflation.

The average two-year fixed-rate mortgage jumped 15 basis points on Friday, the biggest one-day increase since October, with five-year deals following suit, according to Moneyfacts Group Plc. The rate on home loans now stand at 5.64% and 5.32%, respectively, the highest level in five months.

The BOE expects 1.3 million households on fixed-rate deals to be forced to renew their loans between April and the end of the year, ramping up the cost of repayments significantly. Some economists have warned the shock could even tip Britain into a recession.

The PMI survey also showed that prices pressures are easing in the sector with the lowest inflation for almost three years. Construction order books rose at their strongest pace since April 2022, while hiring picked up for a fourth straight month.

(Updates with context in the first paragraph. A previous version’s size and scope for the drop was corrected.)