Chinese equities are set to outperform Indian peers next year as their battered valuations suggest significant upside potential once sentiment turns, according to UBS Group AG.

Stocks in China have currently priced in “lots of negatives,” making them poised for a sharp rebound when catalysts arrive, said Sunil Tirumalai, UBS’ global emerging market strategist. Meanwhile, earnings-based valuations for Indian shares are already at “fairly extreme levels.”

Additional stimulus measures from Beijing and improving geopolitical relations can provide “positive sustained market reaction” for China, he said in an interview last week. “So probabilistically speaking, I think the chances of China outperforming India are high.”

Read: Templeton Says Biden-Xi Meeting May Lift China Stocks

Tirumalai’s stance is a contrarian call, running counter to Wall Street’s deep-rooted pessimism on China and rosy outlooks on India. Just this week, Goldman Sachs Group Inc. downgraded its recommendation on Hong Kong-traded China shares, while touting the South Asian market as having one of the “best structural growth prospects in the region.” Morgan Stanley had a similar take, highlighting hurdles for a sustainable recovery in the Chinese market.

The MSCI China Index has lost about 9% so far 2023, set for its third year of losses, dragged down by the country’s slowing economic growth and geopolitical headwinds. The MSCI India gauge, on the other hand, is poised for its fifth annual gain, buoyed by solid corporate performance.

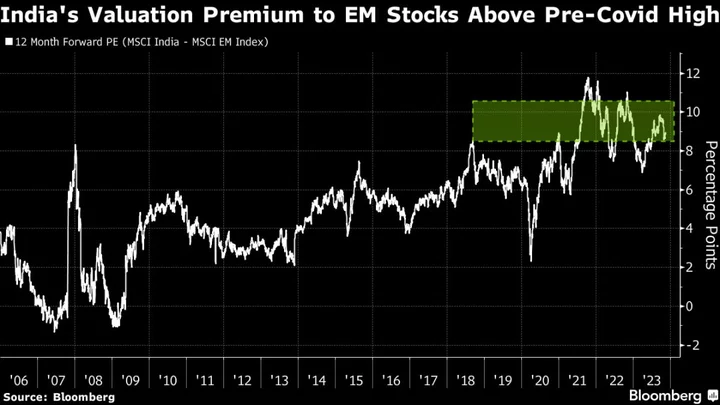

But for Tirumalai, that remarkable win streak is a reason for caution. While shares on the China gauge are trading 9.5 times their forward earnings estimates, the ratio for India stands at above 20.

Shares in the South Asian nation have gotten too expensive, with earnings growth expected to be “very ordinary” compared to emerging market peers over the next few years, he said. The NSE Nifty 50 Index is 8% above his year-end target of 18,000 as of Monday’s close. Local markets were closed Tuesday.

India’s “macro is looking good but the micro isn’t really so strong,” he added.

In an August 2021 interview with Bloomberg, the strategist said investors pulling out of China due to Beijing’s regulatory crackdowns will overlook India as stocks there look pricey. In 2022, India saw a record outflow amid tightening global rates, though the benchmark continued to climb.

Tirumalai is also concerned that a slowdown in retail participation will weigh on Indian markets next year. Individual investors bought 111 billion rupees ($1.3 billion) of stocks on a net basis in 2023 through September, markedly lower than the 1 trillion rupees invested during the same period last year, according to National Stock Exchange of India Ltd.’s data.

Read: Polls to Disrupt India Stocks Calm in 2024, Morgan Stanley Says

He also recommends clients go “long Korea and short Indian equities” in 2024, driven by optimism in technology sector earnings. He also favors “extremely cheap” Brazilian stocks, along with Malaysian, Philippine and Polish shares.