Turkey’s central bank hiked interest rates by double the amount markets expected on Thursday, bolstering the lira.

The Monetary Policy Committee raised the benchmark one-week repo rate by 500 basis points to 40%. The expectation was for an increase of 250 basis points. The lira extended gains after the decision.

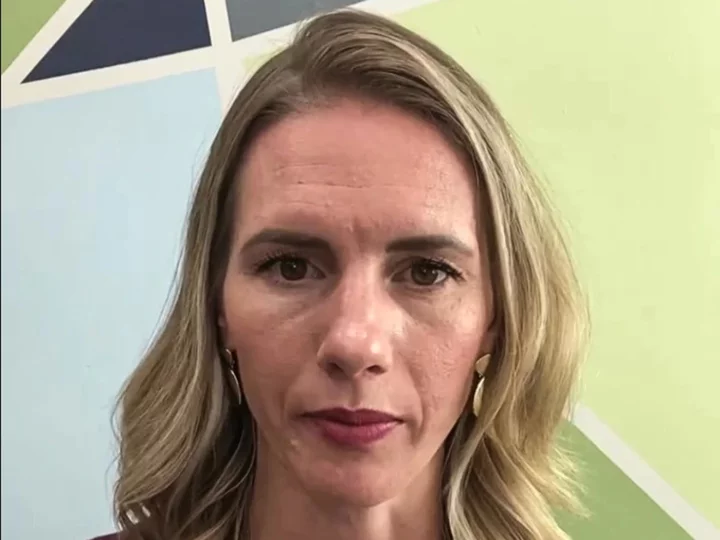

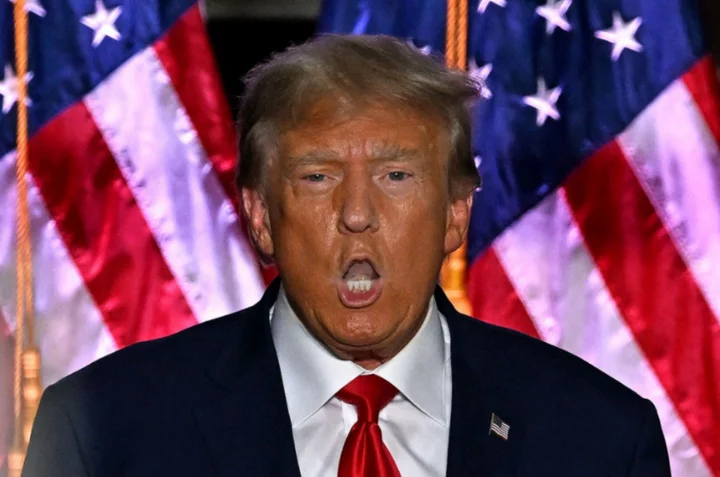

The MPC, led by Governor Hafize Gaye Erkan, signaled it would slow the pace of tightening from now. It’s lifted rates by more than 30 percentage points since President Recep Tayyip Erdogan was re-elected in May, reversing years of loose fiscal and monetary policies that were blamed for enabling inflation to soar and scaring foreign investors away.

“The current level of monetary tightness is significantly close to the level required to establish the disinflation course,” the MPC said in a statement. “Accordingly, the pace of monetary tightening will slow down and the tightening cycle will be completed in a short period of time.”

“The monetary tightness will be maintained as long as needed to ensure sustained price stability,” it added.

The currency traded 0.4% higher at 28.7374 per dollar at 2:06 p.m. Istanbul time, heading for its strongest level since Nov. 17. Yields on two-year sovereign bonds jumped more than one percentage point. The country’s credit default swaps, to protect bond payments over five years, erased an increase.

With its sixth straight rate hike since June, the central bank is turning another corner in ending an era of cheap money. Real rates are now in positive territory relative to projected inflation at the end of 2024, a gauge that’s preferred by policymakers when talking about monetary tightening. The central bank sees inflation at 36% in annual terms by then.

Thursday’s decision will resonate with a market that’s increasingly sensing an opportunity for outsized returns if Turkey stays the course with the makeover of economic policies under Erdogan.

Some of the world’s largest investors such as Amundi SA had said they were looking for a rate increase to at least 40% before pouring money back into local debt markets. Erkan will hold investor talks in New York in January in a bid to encourage such moves.

The symbolic milestone of achieving positive real rates by at least one indicator hinges on the accuracy of the official outlook, which is more upbeat than the views of many economists and the central bank’s own survey of expectations.

And with local elections slated for March, another takeaway for investors is that the pace of Turkish rate hikes is expected for a downshift. Erdogan is keen to win back major cities such as Istanbul and Ankara and may want lower borrowing costs for Turks around the time of the vote.

Erkan has declined to say when she expects rates to turn positive relative to current inflation. She became governor in June, just after Erdogan appointed Mehmet Simsek, a former Merrill Lynch bond strategist, as his new finance minister.

The MPC said it would continue making “quantitative tightening decisions” to support rise in the repo rate. Under similar previous guidance, the central bank tightened reserve requirements for the lira to mop up liquidity in the interbank market.

--With assistance from Srinivasan Sivabalan.

(Updates with MPC statement, market reaction)