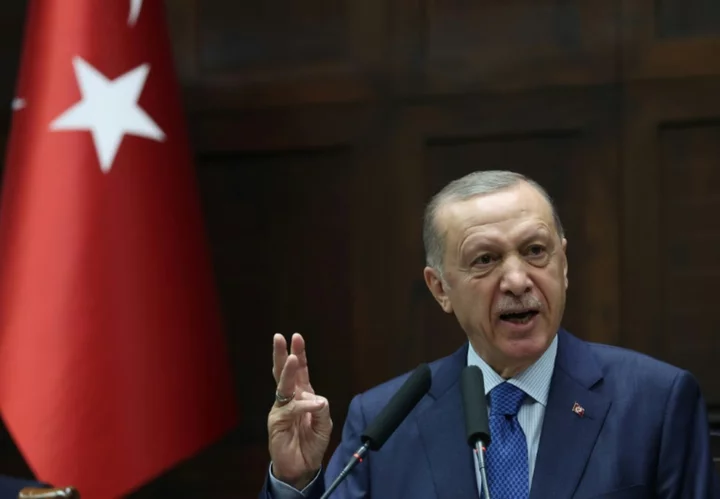

Turkey was widely expected Thursday to pivot away from years of unconventional economics promoted by President Recep Tayyip Erdogan and dramatically raise interest rates to fight inflation and steady the troubled lira.

Erdogan still defends his markets-defying idea that high interest rates contribute to -- rather than cure -- rising consumer prices that have been Turkey's bane for the past five years.

But the central bank is expected to reverse course and double or even tripple the current policy rate in its first meeting since Erdogan filled his government with investor-backed faces after winning tight May polls.

The Turkish leader pushed the central bank to start slashing interest rates two years ago as part of a "new economic model" that focuses on job creation and economic growth.

The policy badly backfired.

The annual inflation rate reached 85 percent late last year and the central bank burned through most of its reserves trying to prop up the lira -- down 90 percent against the dollar over 10 years -- from even bigger falls.

Erdogan was forced into his first election runoff and then orchestrated one of his trademark policy reversals after extending his two-decade rule until 2028.

He appointed respected economist Mehmet Simsek as finance minister and former Goldman Sachs director Hafize Gaye Erkan as the head of the nominally independent central bank.

Turkish media said Simsek agreed to join the government only after winning assurances that he would be free to steady the ship as he saw fit.

Turkey had "no choice but to return to rational ground", Simsek said after taking office.

Erdogan said last week that he "accepted" that his new team would pursue policies that contradicted his own firmly held beliefs.

- How high? -

Simsek's presence has already made an impact.

The lira has lost an additional 15 percent against the dollar since the May 28 election runoff -- a sign that the central bank is slowly unwinding its costly currency defence.

A dollar was worth about 23.55 liras heading into one of the central bank's most closely watched policy meetings in years.

But analysts are deeply divided over how far and how fast Turkey will raise its policy rate from the current 8.5 percent.

Goldman Sachs economist Clemens Grafe said that "an orthodox policymaker would raise rates to 40 percent, the current level of deposit rates".

JPMorgan and the Bank of America both predicted a hike to 25 percent.

But Capital Economics said "there are grounds for caution" because the new team was showing signs of favouring a more slow-moving approach.

"Indeed, the lira's depreciation already appears to have stalled," the London-based consultancy pointed out.

Simsek and newly appointed vice president Cevdet Yilmaz -- a technocrat also admired by investors -- jetted to petrodollar-rich Abu Dhabi on Thursday to drum up new investments and loans.

- Borrowed time -

Foreign investors who initially cheered Erdogan's new appointments now worry about how long the Turkish leader's patience with his new team will last.

Many point to the grim experience of Naci Agbal -- a market-friendly central banker whom Erdogan fired four months into his attempts to raise rates in late 2020 and early 2021.

Some analysts encourage the new team to act quickly and then brace for the possible political fallout.

Others suggest that Turkey's economic problems are too complex to address at the same time.

One of Turkey's most costly programmes involves a bank deposit protection scheme that Erdogan rolled out in late 2021.

It commits the government to cover any losses lira deposits incur from the currency's depreciation against the dollar.

That means that a quick return to a free-floating exchange rate could put an even bigger burden on the strained budget.

Many expect Simsek to gradually phase out the scheme.

Erdogan said Wednesday that he was putting his trust in his new appointments.

"We have placed very heavy responsibilities on our economy management. We have established a strong, harmonious and competent team," he said.

zak/fo/lth