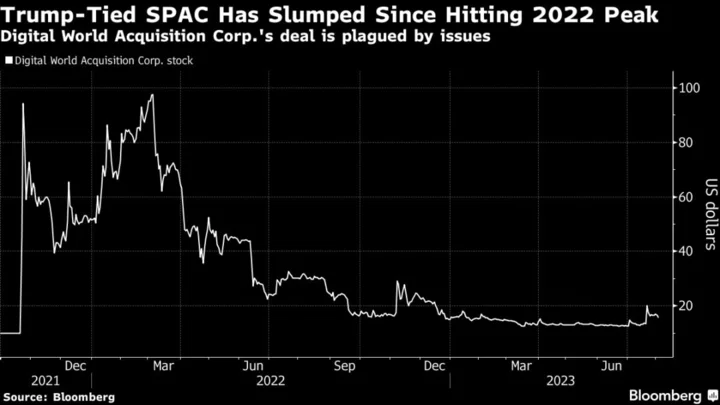

A deal to take Donald Trump’s media company public is facing another major setback, putting into question whether it will ever get completed.

Special-purpose acquisition company Digital World Acquisition Corp. said in a filing Tuesday that its auditor Marcum LLP — which has been riddled with regulatory problems of its own — abruptly resigned. The departure puts its merger with Trump Media & Technology Group in peril.

While the US Securities and Exchange Commission doesn’t technically approve SPAC deals, it requires audited, accurate financial statements to declare such tie-ups effective. So the SPAC must find a new audit firm — fast — to close a deal that has been plagued since its inception nearly two years ago. Shares of Digital World slumped as much as 10% Wednesday.

“It is still a question about whether the deal will ever make it to the finish line,” said Jay Ritter, a finance professor at the University of Florida. “This deal has one of the biggest potential upsides of any SPAC merger, but it has been snakebit from the start.”

The SPAC merger has been the most closely-watched deal of its kind given the former president’s role, the attraction of legions of retail traders and short sellers, and the potential for Trump’s reelection. Just this Tuesday Trump was indicted in Washington on federal charges over his efforts to overturn the 2020 presidential election.

In May, Digital World revealed that it would have to restate, or redo, its 2022 financial results after errors in how it accounted for certain expenses. Marcum quit before completing that work, the company said in the filing. The SPAC blasted Marcum for not adhering to “requisite audit procedures” that would have identified the accounting errors sooner. The firm also dredged up Marcum’s recent $13 million fine to settle regulator charges that the firm had “systemic quality control failures” as it rose to become the top SPAC auditor.

Representatives for Digital World, Trump Media and Marcum didn’t respond to requests for comment.

Julian Klymochko, chief executive officer of Accelerate Financial Technologies, which has a SPAC-focused fund, said Marcum’s resignation is “highly unusual and should be disconcerting for DWAC investors.”

When a company’s auditor departs, the company must alert the market and detail whether the auditor quit or got fired, identify whether a new auditor has been hired and disclose any disagreements between the auditor and the company. Then the auditor must send a letter to the SEC saying it agreed or disagreed with the company’s disclosure. Digital World’s filing was unusual on several fronts: Marcum resigned “without any notice,” didn’t provide details for quitting, and didn’t provide a resignation letter to file with the SEC, the SPAC said in the filing.

“Whenever an accounting firm resigns, it raises a flag as to why they’re withdrawing,” said Usha Rodrigues, a professor of corporate law at the University of Georgia School of Law. “That coupled with not having an accounting firm lined up raises that flag a little higher.”

It can take companies anywhere from a few days to weeks to find a new auditor if they don’t have one already lined up. In rare cases, it can take months.

The highly anticipated SPAC deal has been littered with issues. Just last month Digital World settled SEC allegations that it filed documents that were “materially false.” The SPAC also has struggled to get its die-hard retail shareholder base to vote on key decisions.

Read more: Trump-Tied SPAC Soars as SEC Settlement Clears Hurdle for Deal

As it stands, the takeover must be completed by the Sept. 8 deadline unless the SPAC’s sponsors can persuade investors to extend the deadline at a meeting set for Aug. 17. However, filings show Trump Media believes it could walk away next month if the merger isn’t completed, further complicating the trade for investors.

Author: Bailey Lipschultz and Nicola M. White