Beijing is switching to stimulus mode with clear intensity. Yet the response from investors, who’ve called for stronger support for months, is now fatigue.

That’s the word used by JPMorgan Chase & Co. analysts to explain why risk appetite in Chinese markets remains tepid at best, despite interest-rate cuts and multiple reports that a broader package of measures is imminent. The Hang Seng China Enterprises Index’s gain this month won’t save it from a quarterly loss, and the yuan remains one of the worst performers among major currencies in June.

While investors continue calling for further support, they doubt that authorities will have much success. There’s little conviction that Beijing can boost confidence among the country’s consumers, businesses and the market after almost three years of Covid Zero, property-market deleveraging and stricter oversight of private business.

Unlike late last year, when being wrongfooted by the scrapping of Covid Zero was a real risk in an ultra-bearish market, there’s little appetite among fund managers to position for more stimulus. Only a net 5% of those surveyed by Bank of America Corp. said they were overweight the country’s stocks, down from 9% in May, 27% in April and 39% in March.

Here’s my roundup of the week’s key developments for China markets:

Challenges ahead

China’s youth jobless rate rose to 20.8% in May, a fresh record and four times the country’s overall jobless rate. Unemployment among fresh graduates is a key sticking point for Beijing, as is the property market — whose long-term trend will be “L-shaped” at best, according to economists at Goldman Sachs Group Inc.

- China’s Youth Jobless Rate Hits Record 20.8% as Growth Slows

- Goldman Expects ‘L-Shaped’ Recovery in China Property Market

Stimulus mode

The central bank cut interest rates, shifting gears to boost growth as economic data continued to disappoint. Authorities are also considering a broad stimulus package to support the housing market and get consumers spending.

- China’s Central Bank Ramps Up Rate Cuts as Economy Weakens

- China Considers Developing Domestic High-Yield Bond Market

Wedding bells

Last year saw the fewest weddings since records began in 1985 as the pandemic disrupted plans, a poor sign for China’s population given that most babies are born inside marriage. Couples are also choosing to get married later and urban residents are becoming more skeptical about marriage.

- China’s New Marriages Fall to 37-Year Low, Pressuring Population

Protest song

Hong Kong’s government is seeking to scrub a protest song from the internet. The song, Glory to Hong Kong, has been mistakenly played at sporting events because it features prominently on Google searches for the national anthem.

- HK Protest Song Vanishes From Apple Music as City Seeks Ban

- Hong Kong Bid to Ban Protest Song Spurs Fear of Google Pullout

Foreigners wanted

China will roll out more policies to attract foreign investment, an official said this week. The country, which has been wooing international business leaders in recent weeks, is seeking to address concerns raised by overseas companies. President Xi Jinping welcomed Microsoft Corp. co-founder Bill Gates in Beijing.

- China Plans More Forceful Measures to Attract Foreign Investment

Blinken booked

US Secretary of State Antony Blinken, whose last attempt to visit China was derailed by an alleged spy balloon, is trying again this weekend. Blinken’s reception in Beijing will offer hints at how willing China is to engage at the highest levels.

- Blinken Heads to China Setting Low Expectations: What to Watch

- US Expands China Forced-Labor Embargo, Banning Two New Firms

... and three things to watch for next week

- China’s banks are widely expected to cut their loan prime rates June 20, following the central bank. These underpin the cost of mortgages as well as corporate loans.

- Premier Li Qiang heads to Germany and France earlier in the week. Mainland markets close Thursday and Friday for a holiday, while Hong Kong will be shut Thursday only.

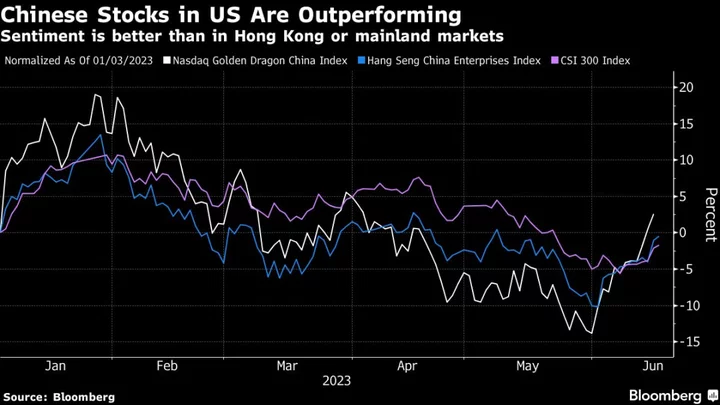

- Investors in New York appear to have a more optimistic view on exposure to China than their counterparts investing via Hong Kong or mainland markets. The Nasdaq Golden Dragon China Index is up 19% in June, leapfrogging the Hang Seng China gauge and the CSI 300 Index.

For a deeper dive into where China stands now — and where it’s going next — sign up to the Next China newsletter.