It’s not a misprint. Telecom Italia SpA, Italy’s beleaguered former telephone monopoly, once pitched a plan to buy Apple Inc.

About 25 years ago a group of executives from the carrier flew to California to meet Apple co-founder Steve Jobs, with an audacious plan to buy the tech company at a time it was struggling to make headway against rivals like International Business Machines Corp.

Telecom Italia, on the other hand, was flying high, ranking as the world’s sixth-largest telephone company by sales. Worth about €90 billion ($100 billion), it had minimal debt, held stakes in dozens of tech groups around the world and employed more that 120,000 people.

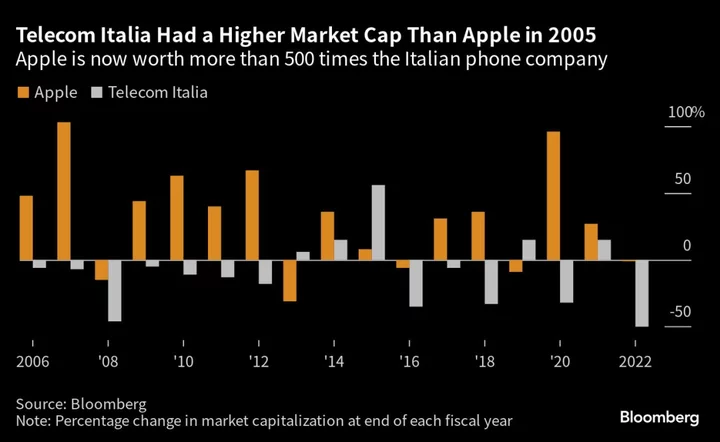

Although Apple’s rise back from the ashes is well documented, the fate of its would-be buyer is less well known outside Italy. Today, the carrier is burdened by more than €30 billion in gross debt, it controls just one company outside its domestic market — Brazil’s No. 3 phone operator — and it employs only a third as many people as it did when its executives made their pitch to Jobs.

Most tellingly, Telecom Italia now finds itself in the position of needing to sell off its landline network just to get its debt pile under control. The sale would be a transformational deal and, if successful, the first such divestiture for a European carrier.

In a small twist of fate, the likely buyer is a US company, though it’s not a tech giant like Apple but private equity powerhouse KKR & Co. With progress being made toward a disposal of the network, Telecom Italia’s one truly valuable asset, now seems as good a time as any to ask, what happened to this once-promising company?

From Cupertino to Colaninno

Flash back to 1998. Onetime Apple executive Marco Landi set up a meeting for his new employer, Telecom Italia, according to his 2018 biography. Chairman Gian Mario Rossignolo then quickly dispatched a team to meet with Jobs at Apple headquarters in Cupertino. Francesco De Leo, at that time Telecom Italia’s managing director, originally designed the proposal.

The group came prepared with a “detailed pitch to buy Apple,” Rossignolo recalled in an interview, noting that the world’s most valuable company was worth just $5 billion at the time. But Jobs turned the Italians down, claiming to already have a deal in place with someone else.

In many ways, that trip to California would be the high-water mark for the phone carrier. Just a year later, the company was bought out by a group of Italian entrepreneurs led by Roberto Colaninno, now chief executive officer at Vespa maker Piaggio & C SpA, in what was Europe’s biggest-ever hostile takeover. The investors paid about 100,000 billion lire (€50 billion) for the company, with at least half the sum financed through debt.

That left Telecom Italia on the sidelines as European rivals embarked on an intense round of industry consolidation. The intervening years have seen a trickling away of sales and earnings, both of which nearly halved over the past decade, as the company’s debt continued to mount.

Cutthroat Market

Last year, Telecom Italia generated revenue of only about €16 billion — compared with around €26 billion in 2012. In the same period, adjusted earnings before interest, taxes, depreciation and amortization tumbled to €5.9 billion from almost €11 billion 10 years earlier.

A spokesman for Telecom Italia declined to comment for this article.

As a former monopoly operator, Telecom Italia has always been hamstrung by a complex mix of high labor costs and ever-higher investments to keep its network infrastructure up to date.

The company also pays a heavy price for spectrum permissions, about €1 billion more than a decade ago for 4G frequencies and about €2.5 billion for 5G in 2018 alone.

Still, none of that fully explains Telecom Italia’s precipitous decline. The real roots of the company’s troubles lie with Italy’s domestic telecommunications environment.

The country has one of the world’s most competitive telecoms markets. Monthly subscriptions for full fiber landline services, which usually include unlimited Internet, can cost as little as €20 to €25, about a quarter of what most US consumers pay.

And competition has heated up in recent years as new players arrive — notably France’s Iliad SA, which entered the Italian mobile market in 2018, positioning itself as a cutthroat, no-frills specialist and sparking an all-out price war.

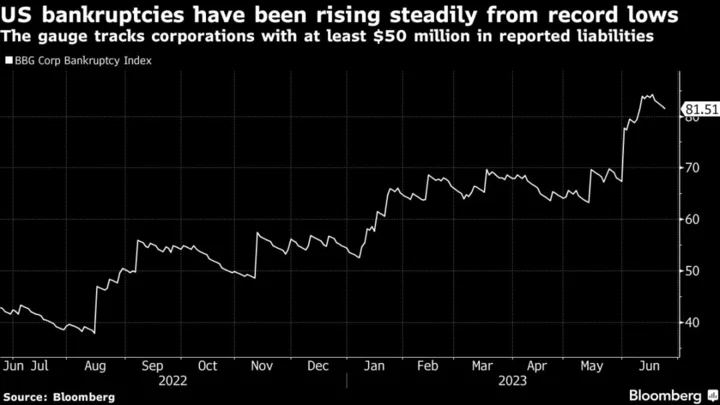

That’s left the carrier in the unenviable position of needing to sell the network, or grid, to tackle all the gross debt built up over the last 25 years. And with interest rates on the rise, the need to sell has become all the more urgent.

Bidding War

In recent months, Telecom Italia found itself at the center of a network bidding war pitting state lender Cassa Depositi e Prestiti SpA, or CDP — essentially the government’s investment vehicle — against KKR, which emerged as the preliminary winner with an offer seen as preferable in terms of price, execution and timing.

The US firm is in exclusive talks with Telecom Italia, and the carrier’s board has given CEO Pietro Labriola a mandate to seek an improved, binding offer by Sept. 30, all of which appears to point toward finalizing a deal to pare the company down and alter its future prospects.

The likely deal is valued at as much as €23 billion, people familiar with the matter have told Bloomberg. The offer includes about €2 billion in a performance-based “earnout” and additional €2 billion if a complex series of conditions are met involving services agreement contracts and changes to the network unit’s debt structure, the people said.

In addition, Abu Dhabi Investment Authority is discussing joining KKR on its bid for Telecom Italia’s grid, people with knowledge of the matter told Bloomberg. Advanced talks are underway.

But what’s at stake appears to outstrip even that level of value. The grid, essentially a digital highway, handles every phone and Internet session that starts or ends in Italy, Europe’s third-largest economy. Given the potential future value of the assets involved, not to mention the strategic ramifications, no other European carrier has ever seriously considered selling off its network.

That’s put Italy’s government front and center in the jostling around the deal. And while the role of Cassa Depositi, the state lender, appears to be on the wane, the administration led by Prime Minister Giorgia Meloni clearly wants to retain a healthy degree of oversight over the grid.

That could come through local players such as Milan-based infrastructure fund F2i SGR SpA, which features public entities among its shareholders. Indeed, F2i has already started talks with KKR about an eventual minority stake in the grid, people with knowledge of the matter told Bloomberg last month.

The French Dilemma

But a number of hurdles remain.

Rome holds the right to veto deals involving strategic assets, and the government’s desire to safeguard the carrier’s 40,000 employees means that any offer without state backing would face significant hurdles.

The network sale looks even more complex considering the strong opposition of the carrier’s largest shareholder, Vivendi SE. The French media group has repeatedly warned that it won’t accept any offer for the network below €30 billion.

As Telecom Italia’s top investor, Vivendi has a range of options. It could push the carrier to pivot to a takeover plan drawing in all of the current suitors. Or it could opt for an alternative path, possibly involving the sale of the carrier’s Brazil unit Tim SA, the people said. It could also seek a board reshuffle, which might augur poorly for the CEO.

Regardless of the outcome of the network battle, the carrier won’t look the same after the dust has settled.

“Telecom Italia’s future will now be mostly linked to its capacity of being more agile and luring new customers with more profitable services,” said Laura Rovizzi, chief executive at Rome-based strategy and regulation consultant Open Gate Italia.

And the carrier’s service unit, basically all that would remain of Telecom Italia after a network selloff, would itself probably need to weigh a transformational deal with a tech company to guarantee its competitive footprint, she added.

With so many uncertainties ahead, there’s probably only one safe bet for Telecom Italia. The carrier won’t be trying to buy Apple again.

--With assistance from Tommaso Ebhardt.