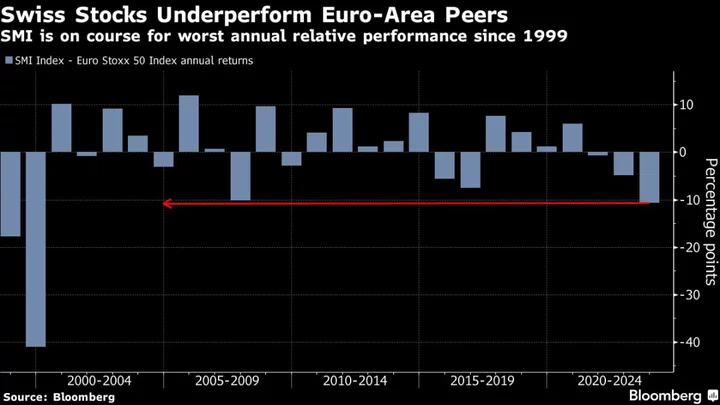

Switzerland’s typically staid stock market is headed for its worst annual showing against euro zone peers since 1999, after its biggest companies disappointed investors this earnings season.

The Swiss Market Index has slid 1.5% year-to-date, contrasting with gains for European and US shares. It’s calling into question the gauge’s reputation as a haven in turbulent times — last month, as investors dashed for so-called defensive stocks, they bypassed the SMI, which fell 5.2%.

There are several explanations.

First, the SMI gauge is pretty concentrated — Roche Holding SA and Nestle SA make up more than 30% of it. And shares in both have slid since reporting results. Roche took a hit from falling sales of Covid medicines, while food conglomerate Nestle missed expectations and is seen as a possible loser from the boom in weight-loss drugs. Novartis, the second-biggest member of the SMI, also failed to excite investors.

Andrea Fornoni, who manages a Swiss-equity fund at Fidelity International, has cut exposure to Swiss stocks and has loaded up on cash instead.

“When companies missed in this past earnings season, the market reaction was quite harsh compared to other periods, which in itself shows investors are quite nervous and think there are more earning downgrades to come,” Fornoni said. He doesn’t expect a rebound for the SMI this year or at the start of next.

On top of a poor earnings season, profit expectations for SMI members are significantly lagging those of euro zone rivals. Forward earnings per share of Euro Stoxx 50 companies has risen nearly 30% since the start of 2021, compared with almost no growth for the SMI.

Many Swiss companies have also suffered this year from negative currency effects. The Swiss franc has gained about 3% against both the euro and dollar this year — a big headwind for companies like Cartier owner Richemont and industrial conglomerate ABB Ltd., which generate the majority of revenues overseas.

The make-up of the SMI also helps to explain its underperformance. Dominated by consumer and pharmaceutical stocks, it has missed out this year’s frenzy around artificial intelligence and technology stocks, said Thomas Christen, senior equity portfolio manager at Bergos AG.

Then, there is competition from the real safe-haven assets — bonds.

With government bonds in Switzerland and across Europe no longer paying sub-zero rates “the re-emergence of real yields from traditional safe havens have drawn away potential investors,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP.

Finally, Swiss equity valuations remain pricey, potentially denting the prospects of a recovery: the SMI Index trades at 15.6 times forward earnings, well above the 11.5 times for the Euro Stoxx gauge.

Still, there are some bright spots for Swiss stocks. The SMI’s fourth-largest member, UBS Group AG, is up more than 30% this year and reported results on Thursday that impressed analysts. And some strategists, like those at JPMorgan Chase & Co., believe the country’s defensive attributes will prevail eventually, especially in a downturn.

They are overweight Switzerland, while being underweight US and euro area stocks. Swiss stocks have a limited correlation to global markets, which might “come in handy,” strategist Mislav Matejka said.