President Xi Jinping has resisted pulling the trigger on a major stimulus to revive the world’s second-biggest economy. The grim market reaction to a surprise rate cut shows investors want to see him take much bolder steps.

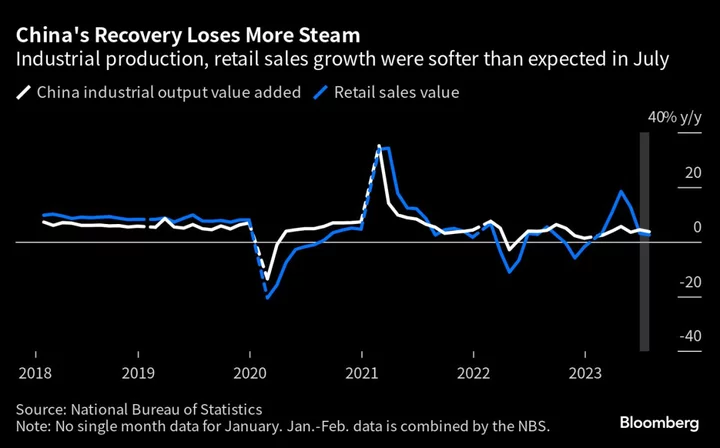

The People’s Bank of China on Tuesday lowered the rate on its one-year loans — or medium-term lending facility — by 15 basis points to 2.5%, the steepest cut in three years. The move came shortly before the release of July data that showed weak consumer spending growth, sliding investment and rising unemployment.

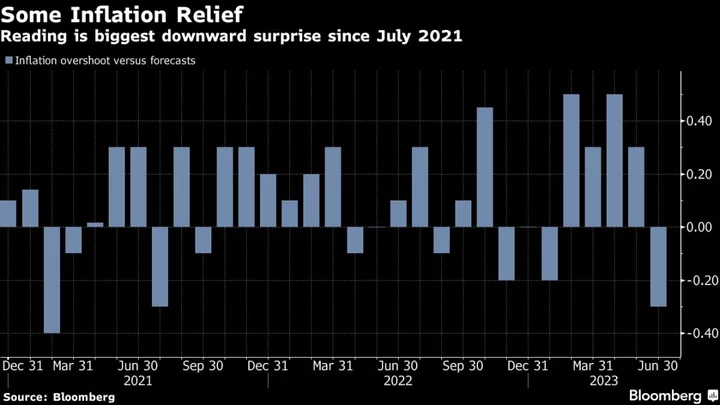

Zooming out, the economic picture looks even worse. Bank loans plunged to a 14-year low last month, while deflation is setting in and exports are contracting. One of China’s largest property developers is at risk of default and a financial conglomerate with 1 trillion yuan ($138 billion) under management missed payments on investment products, stoking fears about possible contagion.

All of that is adding pressure on Xi to do more in two areas he has sought to avoid: Helping out the heavily indebted property sector and giving consumers more cash to spend — something an adviser to the People’s Bank of China this week called “the most urgent goal.”

The failure to revive confidence more broadly risks leading to economic pain that could blow back on Communist Party leaders. Last year saw a wave of mortgage boycotts and unprecedented protests against Xi himself as residents got fed up with the world’s strictest Covid-19 restrictions.

Chinese authorities remain sensitive about the narrative over the economy, instructing analysts to avoid discussing deflation and restricting access to key data. China on Tuesday suspended publishing data on its soaring youth unemployment rate to iron out complexities in the numbers, fanning fears about transparency.

“The declining economy dramatically increases the risk of unrest,” said Drew Thompson, a former Pentagon official and businessman in China who is now a senior fellow at the Lee Kuan Yew School of Public Policy in Singapore. “The Communist Party should be circling the wagons.”

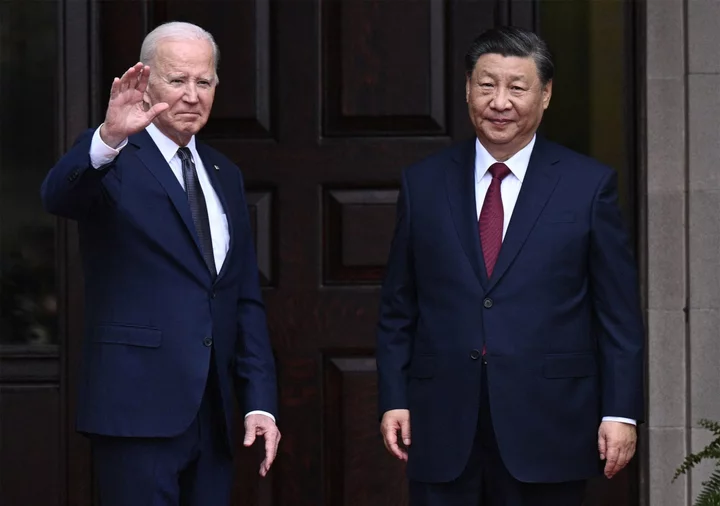

The struggles facing China are also bad news for the world. Stocks and bonds declined as concern grew that the global economy will suffer without a sustained recovery in China, which the International Monetary Fund has previously projected would be the top contributor to global growth through 2028.

US Treasury Secretary Janet Yellen this week said China’s slowdown was a “risk factor” for the American economy. Weaker imports of major commodities also threatens producers from Australia to Brazil, while softer demand for electronics will impact trade-dependent economies like South Korea and Taiwan.

The CSI 300 Index, a benchmark of onshore China stocks, ended 0.2% lower even after Bloomberg reported that Chinese authorities may cut the stamp duty on stock trades for the first time since 2008 — news that helped boost sentiment after the rate cut and weak Chinese data failed to impress investors.

While some economists were more encouraged by the central bank’s actions than others, all seemed to agree on one thing: Authorities have more work to do on both the monetary and fiscal side.

“The PBOC rate cuts today set the stage for looser liquidity conditions that could eventually support an even bigger fiscal push,” said Louise Loo, lead economist at Oxford Economics Ltd. “So that is encouraging.”

Economists at Australia & New Zealand Banking Group Ltd., including Xing Zhaopeng and Raymond Yeung, said the rate on the PBOC’s one-year policy loans may need to be reduced to 1.2% — a terminal rate implying additional cuts of 130 basis points. Rate cuts, they said, will “smooth the shocks and buy time for structural reforms” such as upgrading industry, greater urbanization and more deleveraging.

“China’s slowdown is more structural than cyclical,” they said.

Welfare Trap

Still, some economists have said the government’s strategy so far is doing little to move the needle, especially as the property crisis worsens.

“The PBOC wants to get the banks to lend, but it seems it’s not been successful as both loan demand from households and credit-worthy corporations have been weak,” said Redmond Wong, market strategist at Saxo Capital Markets. He said that’s because banks have been reluctant to lend to property firms and other private companies, given the uncertainty surrounding the ability of those businesses to pay back their debts.

Country Garden Holdings Co. — once China’s largest developer by sales — now faces potential default despite being a recipient of government-led support for the sector. Fears that problems at Country Garden and other developers are spilling over elsewhere have been exacerbated by reports of payment problems linked to Zhongzhi Enterprise Group Co., a multi-billion-dollar shadow banking firm.

What Bloomberg Economics Says ...

“China’s activity data show the economy skidding into the second half of the year — clear reason for the swift and unusually large rate cut Tuesday. The readings on production, investment and consumption all undershot expectations, showing June’s rate cut didn’t move the dial.”

— David Qu and Chang Shu, economists

For the full report, click here.

“The latest financial problems with one of the country’s largest developers throws cold water on recent policy measures aimed to revive a troubled sector,” said David Chao, global market strategist for Asia Pacific ex-Japan at Invesco Ltd.

The government’s inability to stem the property downturn or boost confidence among businesses and households has led some to argue for more dramatic measures. Cai Fang, a central bank adviser, this week said it is “necessary to use all reasonable, legally compliant and economic channels to put money in residents’ pockets.”

Cutting checks for consumers, though, has long been viewed as a non-starter within a government that has repeatedly warned against the trap of “welfarism.”

Andrew Batson, China research director for Gavekal Dragonomics, wrote in a note earlier this month that Chinese policymakers were likely reluctant to use direct transfers to households as a short-term stimulus due to fears of “setting a fiscally destabilizing precedent.”

“The next time China falls short of potential growth and full employment, the political pressure to roll out household transfers again would be overwhelming,” Batson wrote. “What started as a one-off policy response could become entrenched as the expected response to any growth slowdown, and would add to government deficits and debt over many years rather than just one.”

With no elections to worry about, and more power than any leader since Communist Party founder Mao Zedong, Xi is betting that he can ride out the downturn.

--With assistance from Rebecca Choong Wilkins, Ishika Mookerjee, Yujing Liu and James Mayger.