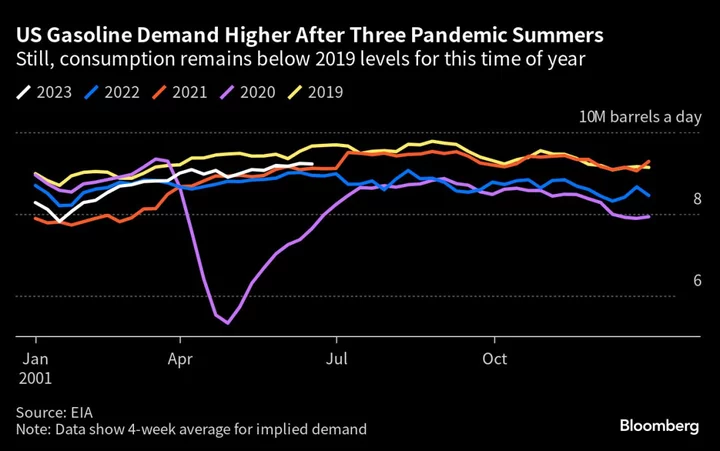

After three pandemic summers, a record number of Americans will hit the highway this July 4th weekend, but even that won’t return the country’s struggling gasoline sector to its pre-Covid peak.

More than 43 million motorists will drive 50 miles or more from their homes this Independence Day weekend, according to a forecast from AAA. That’s 4% more than in 2019 and would mark a new record. Several years of pent up demand and lower prices at the pump are largely to thank, with gasoline more than a dollar per gallon cheaper compared to last year.

Throw in travel by planes, buses, cruise ships and trains, and holiday travel will hit an all-time high of 50.7 million Americans during the five-day period from Friday, June 30 to Tuesday, July 4, the motor club predicts.

“We’ve never projected travel numbers this high for Independence Day weekend,” said Paula Twidale, senior vice president of AAA Travel. “What this tells us is that despite inventory being limited and some prices 50% higher, consumers are not cutting back on travel this summer.”

But while record driving is good news for gasoline and the refiners who supply it, the widespread adoption of more efficient vehicles means fuel demand nonetheless remains muted — and might never get back to pre-pandemic rates. Last year saw the biggest annual jump in efficiency for US cars in more than a decade, with the average car now getting 33.3 miles on a gallon of fuel, according to preliminary data from the Environmental Protection Agency. Although that’s a plus for the environment, it means fuel use — still almost 5% below the same time in 2019 — in all likelihood will never return to that level again.

That’s what the data showed during Memorial Day weekend, the unofficial start to the US driving season. Although AAA had predicted around 6% more travelers would drive during the late-May holiday weekend, US drivers ultimately consumed 1.5% less gasoline compared with a year ago, according to Patrick De Haan, head of petroleum analysis at GasBuddy.

Despite the slowdown in gasoline consumption, the US market is still one of the brightest spots for global fuelmakers. That has drawn a rush of gasoline imports from Europe, Asia, the Middle East and South America.