By Lawrence Delevingne and Amanda Cooper

Global stocks advanced on Tuesday as positive corporate earnings spurred some investor risk appetite, although caution remained given the war in the Middle East and mixed economic data ahead of closely-watched interest rate policy decisions.

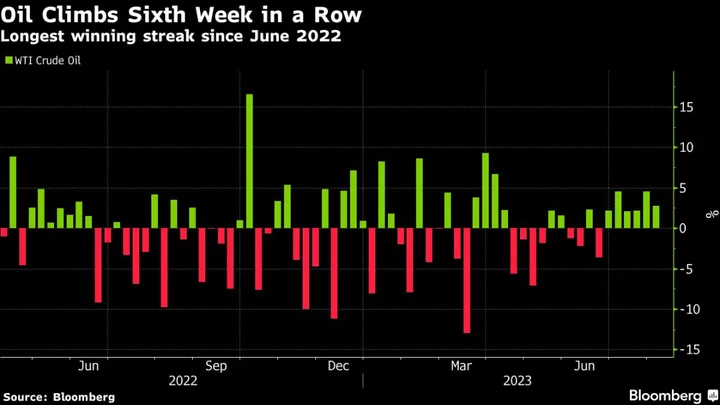

Oil fell further after weak economic data suggested reduced demand, eclipsing worries that the Israel-Hamas war could escalate into a wider conflict in the crude-exporting region.

The U.S. dollar gained, while bitcoin was up another 7%, adding to its biggest one-day rally in a year on Monday.

On Wall Street, upbeat forecasts from Verizon, Coca-Cola and other companies boosted optimism about corporate America's health in the face of a slowing economy and higher inflation. The Dow Jones Industrial Average rose 0.6%, the S&P 500 gained 0.7%, and the Nasdaq Composite added 0.9%.

U.S. business activity ticked higher in October and output in the euro zone took a surprise turn for the worse, surveys showed on Tuesday.

Sameer Samana, senior global market strategist at Wells Fargo Investment Institute, said recent economic data suggests that parts of Europe, especially Germany, may be headed for recession, while the U.S. data was better than expected.

"Geopolitics and politics continue to hang over the market’s head, but it’s hard to know which way they will break," Samana wrote. "We would continue to play defense within both equities and fixed income, while waiting for a better opportunity to add risk."

The MSCI All-World index rose about 0.5%, while an index of Asia-Pacific shares outside Japan edged above a one-year low.

In Europe, the STOXX 600 added 0.44%, with declines in banking shares such as Barclays offset by gains in the likes of luxury group LVMH and Swiss computer parts maker Logitech.

Investors do not expect the European Central Bank to raise interest rates when it meets this week, but are still prepared for borrowing costs to remain high.

"The looming spectre of inflation grows even more imposing, especially considering the recent sharp ascent in oil prices," said Dalma Capital Chief Investment Officer Gary Dugan.

"If oil prices persist at this level throughout the rest of 2023 and into 2024, this could potentially inject another bout of inflation into the global economy."

THE 5% CLUB

Global bond yields have surged in recent weeks, in part because of a growing belief that central banks will have no room to cut interest rates until well into 2024.

The run-up in yields on the 10-year Treasury note to 5% on Monday reflected that belief. The 10-year note was last yielding 4.819%, little changed on the day.

BlackRock CEO Larry Fink said he believed U.S. rates would stay higher for longer, given the amount of fiscal stimulus entering an already resilient economy and robust wage growth.

"I do believe the Federal Reserve will have to raise rates higher, which probably will mean that by 2025 we may have a soft landing. We may have hard landing. That is the only way that I see that we’ll be arresting this. But I don’t expect it any time soon," Fink said at a gathering of financial leaders in Riyadh.

Investor attention will be split this week between the earnings of high-profile companies, including Microsoft, Facebook parent Meta Platforms and Amazon, as well as a slew of economic data ahead of the Fed's meeting from Oct. 31 to Nov. 1.

Third-quarter gross domestic product data on Thursday, along with the Personal Consumption Expenditures (PCE) report, the U.S. central bank's preferred inflation gauge, on Friday, could help shape medium-term expectations for U.S. rates.

In the currency market, the dollar rose 0.6% against a basket of currencies, reversing Monday's 0.5% drop.

The yen held steady against the dollar, but was not too far from 150 per dollar - a level markets believe could prompt Japanese authorities to intervene to prop up the currency.

"We believe this current dollar weakness is corrective in nature," Brown Brothers Harriman & Co strategists wrote in a note. "Looking beyond the current noise related to dovish Fed comments, nothing fundamentally has changed and we see no reason to believe the dollar’s uptrend has ended."

In cryptocurrencies, bitcoin rose to 18-month highs, as speculation about the possibility of an exchange-traded fund drove enthusiasm and prompted short-sellers to exit positions. The world's biggest cryptocurrency eased slightly to $33,712, up about 7% on the day.

Oil prices extended losses for a third straight session after a flurry of economic data from Germany, the wider euro zone and Britain sketched a bearish picture which could weigh on oil demand. U.S. crude and Brent both settled down about 2% per barrel on the day.

Spot gold was little changed at $1,972 an ounce.

(Reporting by Lawrence Delevingne in Boston and Amanda Cooper in London. Additional reporting by Ankur Banerjee in Singapore; Editing by Mike Harrison, Mark Potter, Toby Chopra, Marguerita Choy and Leslie Adler)