BEIJING (AP) — Global stock markets fell Wednesday as traders awaited a U.S. jobs update and notes from the latest Federal Reserve meeting for guidance on interest rates.

London, Shanghai, Paris and Tokyo declined. Wall Street futures were lower as U.S. markets prepared to reopen after a holiday. Oil prices were mixed.

Notes from the monthly Fed meeting at which its key interest rate was left unchanged are due for release Wednesday. Fed officials have said rates might be raised two more times this year, but traders hope they will decide enough already has been done to cool inflation.

On Friday, the U.S. government is due to report employment, a factor watched by the Fed.

“Interest rate expectations could be reshaped depending on how the cards fall with regards to these key releases,” said Tim Waterer of KCM Trade in a report.

In early trading, the FTSE 100 in London lost 0.4% to 7,486.89. The CAC 40 in Paris lost 0.5% to 7,332.92 and the DAX in Frankfurt retreated 0.4% to 15,966.73.

On Wall Street, futures for the benchmark S&P 500 index and the Dow Jones Industrial Average were off 0.3%.

In Asia, the Shanghai Composite Index fell 0.7% to 3,222.94 after a measure of China's service industry activity fell to its lowest level this year, adding to signs its recovery following the end of anti-virus controls is cooling.

The monthly purchasing managers' index issued by a Chinese business magazine, Caixin, fell to 53.9 from May’s 57.1 on a 100-point scale on which numbers above 50 show activity increasing. A measure of factory activity also declined.

“Without policy support, there’s a risk that weakening growth expectations could become self-fulfilling,” said Stephen Innes of SPI Asset Management in a report.

The Nikkei 225 in Tokyo retreated 0.2% to 33,338.70 and the Hang Seng in Hong Kong lost 1.6% to 19,110.38.

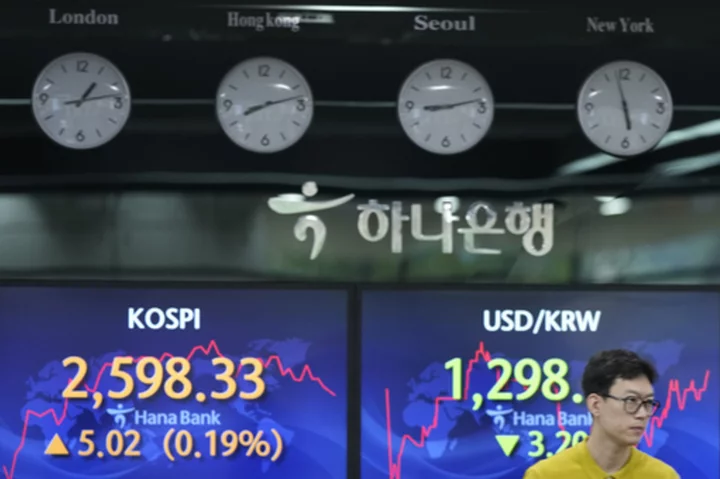

The Kospi in Seoul retreated 0.6% to 2,579.00 and Sydney's S&P-ASX 200 shed 0.4% to 7,253.20.

India's Sensex lost 0.3% to 65,301.84. New Zealand and Jakarta gained while Singapore and Bangkok declined.

China's economic activity accelerated to 4.5% in the first three months of 2023 from last year's 3%. China's No. 2 leader, Premier Li Qiang, said last month growth was improving. He gave no details but expressed confidence China can hit this year's official growth target of “about 5%.”

Traders are uneasy about U.S.-Chinese tensions over technology trade after Beijing this week announced restrictions on exports of gallium and germanium, two metals used in making semiconductors and solar panels. That came ahead of Treasury Secretary Janet Yellen's visit this week as part of U.S. efforts to restore strained relations.

In energy markets, benchmark U.S. crude rose 96 cents to $70.75 per barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the price basis for international oil trading, lost 62 cents to $75.63 per barrel in London.

The dollar declined to 144.28 yen from Tuesday's 144.46 yen. The euro gained to $1.0880 from $1.0870.