South Korea will avoid capitalizing on China’s ban on a US chipmaker, seeing the move by Beijing as an attempt to drive a wedge between Seoul and Washington, according to a person familiar with the situation.

The South Korean government won’t encourage its memory-chip firms to grab market share in China lost by Micron Technology Inc., which has been barred for use in critical industries by Beijing on national security grounds, said the person, who asked not to be identified as the topic is politically sensitive.

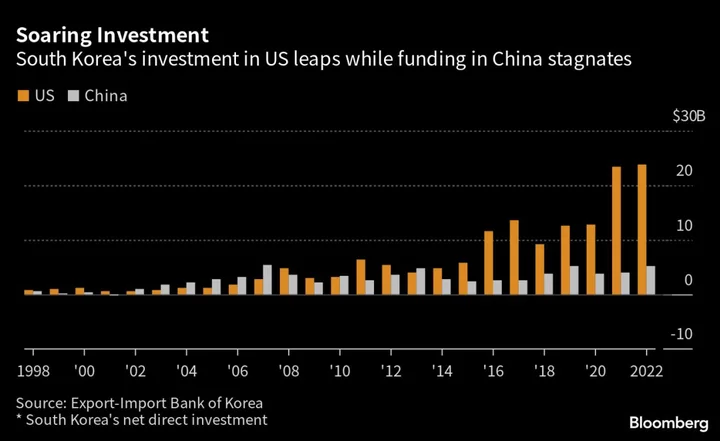

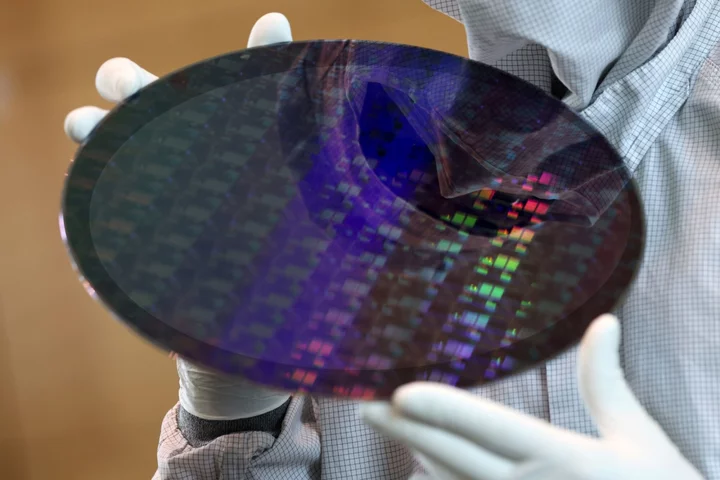

China is the biggest market for South Korea semiconductor firms Samsung Electronics Co. and SK Hynix Inc. and home to some of their factories. Their continued operations in China are dependent on licenses granted by Washington, giving the US some leverage over Seoul’s decisions on how it balances its economic engagement with both countries.

South Korea is also wary of taking advantage of the Micron situation as it sees the US as a key long-term partner for its semiconductor industry and doesn’t want to disrupt that relationship, said the person.

China’s Micron decision has drawn South Korea into the US-China battle over technology access and national security. While Washington is Seoul’s top security partner, China is South Korea’s biggest trade partner.

Export Controls

Washington, along with allies in Japan and the Netherlands, has imposed a series of export controls on chipmaking equipment and knowhow to Beijing as the world’s top two economic powers increasingly square off in trade and technology.

“A broader ban of Micron semiconductors puts South Korea in the worst of both worlds,” said Troy Stangarone, senior director at the Korea Economic Institute. If South Korean companies don’t help with filling the gap left by Micron, China may penalize them the way it did for Seoul’s previous decision to deploy on its soil a US anti-missile defense system, known as Thaad, he said.

The Financial Times reported earlier this month that South Korea signaled it would allow its companies to fill the gap left by China’s Micron ban. The government in Seoul denied that, saying it had yet to announce any formal position.

It remains unclear whether China would expand its crackdown on US chipmakers or how the US will respond to Beijing’s ruling on Micron. The two sides have recently tried to lower tensions and restore high-level talks, including meetings this week between top commerce officials in Washington.

Micron gets about 11% of its revenue from companies headquartered in mainland China. The company estimates total sales to China — combining direct sales plus indirect through distributors — comes to about 25% of revenue. It said May 22 it was still evaluating the impact of the critical information infrastructure ban.

In a briefing on Saturday, US Commerce Secretary Gina Raimondo said the US was speaking to allies about China’s action on Micron. “We see it as plain and simple economic coercion,” she said. “And we won’t tolerate it, nor do we think it will be successful.”

Read more: US ‘Won’t Tolerate’ China’s Micron Chips Ban, Raimondo Says

The Chinese commerce ministry said in a statement after talks with South Korea amid the Asia-Pacific Economic Cooperation forum in Detroit this week that the sides had agreed to strengthen cooperation on semiconductor supply chains.

A separate statement from the South Korean trade ministry made no reference to chips and instead said they discussed cooperation on stabilizing critical commodities and components.

(Updates with Micron revenue breakdown in 10th paragraph.)