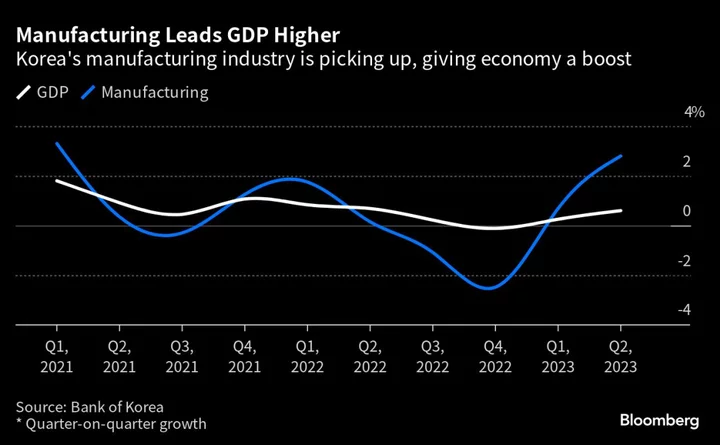

South Korea’s economic growth accelerated on the back of a pickup in manufacturing, offering signs of an ongoing recovery as the central bank keeps monetary policy restrictive.

Gross domestic product advanced 0.6% in the three months through June from the previous quarter, Bank of Korea data showed Tuesday. Economists surveyed by Bloomberg forecast a 0.5% expansion after the 0.3% advance in the previous period. Net trade also supported the expansion, though the impact largely came from a fall in imports.

The economy has now advanced for a second quarter since contracting in the last three months of 2022. The BOK has kept its key interest rate steady, with a hawkish bias, for most of this year as it seeks to balance its inflation fight with the need to safeguard economic activity.

“Manufacturing will likely continue to rebound and normalize despite the talk of a recession as the impact of the pandemic recedes,” said Chang Jaechul, chief economist at KB Kookmin Bank.

The latest expansion gives the BOK scope for keeping policy tight as the US Federal Reserve is widely expected to hike rates by a quarter point on Wednesday, widening the rate differential between the new two nations.

What Bloomberg Economics Says...

“Faster growth momentum makes it easier for the Bank of Korea to stick with its hawkish stance for now.”

- Hyosung Kwon, economist

For the full report, click here.

After being buffeted by an export slump since last year, Korea last month posted its first trade surplus in 16 months. Consumer confidence also breached the threshold of 100, indicating that optimism has returned among households.

Still, concerns about the strength of momentum remain. Early trade data showed exports in July falling at the fastest clip since March, and uncertainties remain over the timing of any potential rebound in the key chip sector and a recovery of demand in China, Korea’s biggest trading partner.

Tuesday’s report underscored some of those concerns. Net exports were a big contributor to second-quarter growth, but only because exports weren’t as weak as imports. Shipments overseas fell at a smaller pace than the 4.2% drop in imports. Also, government spending declined 1.9%, the most since 1997, as the budgetary stance remained tight, and private consumption slipped moderately.

Both the central bank and government recently slashed their growth forecasts for the year to 1.4%.

Chang at KB Kookmin Bank said private consumption poses a risk to the growth target while exports will likely keep improving on the back of recovering demand for electronics and technology products.

On the price front, headline inflation eased for a fifth month in June, but gains in the core price gauge have proven stickier than expected. While the pace of inflation may slow in July, price growth is likely to accelerate again to the 3% level around the end of the year, according to the central bank.

The BOK kept its key rate unchanged this month for a fourth straight meeting, while noting that its inflation battle is still not over. The BOK has a target of 2% inflation.

(Updates with economist comments, breakdown of expenditures and a chart)