SoftBank Group Corp.’s flagship Vision Fund reported another loss as valuations on some of its bets declined, even as the investor chases new deals in AI.

The Vision Fund segment reported a loss of ¥258.9 billion ($1.7 billion) in the September quarter, compared with a ¥1.02 trillion loss a year ago.

That contributed to a surprise group-wide net loss of ¥931.1 billion, down from a profit ¥3.03 trillion last year when SoftBank cashed in on its stake in Alibaba Group Holding Ltd. Analysts on average had estimated a group net income of ¥203.4 billion.

SoftBank is trying to regain its footing after its Vision Fund unit lost $53 billion in the last two years on startups like WeWork Inc., which just filed for bankruptcy. The $4.9 billion initial public offering of chip unit Arm Holdings Plc has given SoftBank fuel to start afresh.

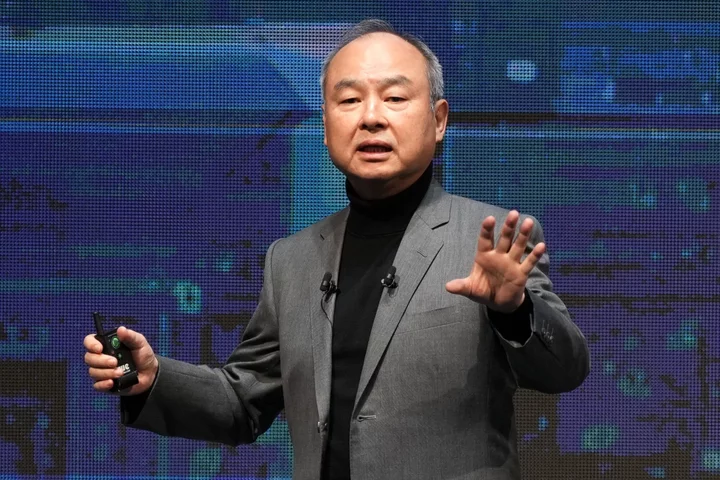

Founder Masayoshi Son has made a series of bets this year on autonomous technologies, particularly in transportation and logistics. They include investments in autonomous trucking startup Stack AV, an AI-using warehousing joint venture with Symbotic Inc. and a follow-on investment in Vision Fund portfolio firm and navigation software maker Mapbox Inc.

“There is a risk that FOMO on generative AI drives the narrative,” Astris Advisory analyst Kirk Boodry said in a note to investors prior to the announcement. “Clearly if Masa is keen on something, then SoftBank will make that investment, leaving any discussion about guardrails and/or a more conservative approach academic.”

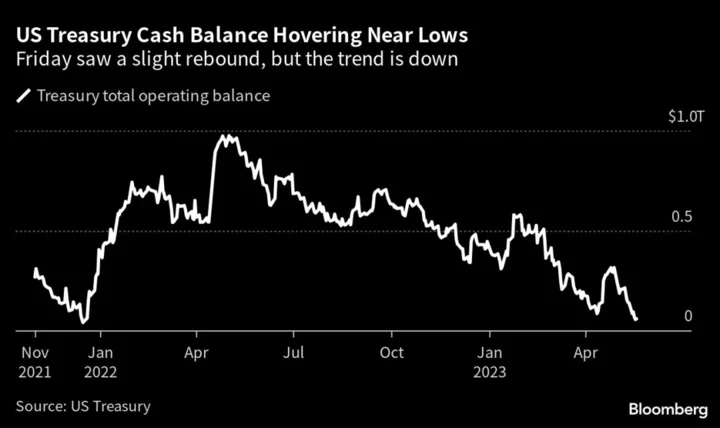

SoftBank invested billions of dollars in unprofitable startups from 2017, inflating valuations worldwide before they were punctured by China’s tech crackdown starting 2020 and the US Federal Reserve’s rate hikes last year. The company spent months writing down losses while limiting new investments, cushioning losses in the last two quarters.