Australia’s depreciating currency, historically a boon for the world’s 12th largest economy, appears more likely to fuel inflation this time rather than deliver a tailwind to its import-competing industries.

The Australian dollar is among the worst-performing developed-market currencies in the past year, a trend that looks set to persist. That reflects a deepening slowdown in the nation’s No. 1 customer which is China, the Reserve Bank’s lower interest-rate profile compared with the Federal Reserve and an improving US economic outlook.

The erosion of Australia’s manufacturing means the currency shedding more than 11 US cents from its April 2022 peak of 76.61 US cents is unlikely to boost the local economy much now.

Instead, it may push up import costs with tradable goods comprising almost half of the consumer price basket, complicating the RBA’s efforts to return inflation to its 2%-3% target from around 6% at present.

“At this juncture the currency is less about the kind of traditional shock absorber and boost to activity, but the risk that it places on the inflation story,” said Su-Lin Ong, chief economist for Royal Bank of Canada in Sydney. “The weaker this currency goes, the greater the risk of higher imported inflation that’s passed through to final prices.”

Australia’s economy has become more concentrated in the past 15 years as soaring commodity prices spurred massive investment in iron ore mines and the development of natural gas fields to meet demand in Asia-Pacific. Meanwhile, traditional manufacturers like carmakers have been shuttered.

That has blunted the benefits of a lower exchange rate, which in 2008, 2001 and 1998 helped the economy to avoid a recession.

At the same time, the contribution to Australia’s inflation basket from imported goods climbed to about 46% in the three months to June, up from about 37% in same period in 2017, according to the Australian Bureau of Statistics data.

Australia does have significant services industries like international education and tourism that will be cheaper and more competitive with a weaker currency.

Yet even in those areas, there are potential impediments to the nation fully cashing in. The government’s recent decision to block Qatar Airways’ request for more flights may discourage some visitors from traveling to Australia.

What Bloomberg Economics Says...

“Structural changes in Australia’s economy are reshaping the shock-absorbing role of the currency — a smaller manufacturing sector means less scope for goods demand to be pushed onshore. This could lead to higher import prices having a larger impact on consumers than previous cycles, complicating the RBA’s progress in reining in inflation.”

— James McIntyre, economist

The Australian dollar has averaged 75.6 US cents in the 40 years since it was first floated on Dec. 12, 1983. It’s currently trading a bit above 65 US cents. Commonwealth Bank of Australia, the nation’s largest lender, sees it slipping to 64 US cents by year end.

Yet that’s among the more bearish forecasts, with the median estimate 69 US cents in the final three months of the year. Westpac Banking Corp. recently trimmed its expectation to 68 US cents, with Senior Currency Strategist Sean Callow saying the level is elevated by its economists’ optimism about China.

“The Aussie is trading very heavily. It’s clear there’s a lot of gloom about it,” Callow said. With risk appetite remaining fragile, the Aussie could re-test the year-to-date low toward 64.58 US cents “so near term, I’m certainly inclined to sell rather than buy.”

The Aussie dollar often trades as a proxy for China and this suggests further downward pressure ahead. The world’s second-largest economy faces myriad problems: Sluggish consumer spending, a shaky property market, flagging exports amid a US drive for “de-risking” and towering local government debt.

Then there’s the interest-rate differential between Australia and the US. The RBA has been more cautious than peers during the current tightening campaign, accepting a longer route back to its inflation target to try to secure a soft landing. It has increased borrowing costs by 4 percentage points, well behind the 5.25 points delivered by the Fed.

One group that has benefited from a weaker currency is resource firms and, in turn, the nation’s fiscal coffers. Commodities priced in dollars have swelled Australian profits and corporate tax payments.

“This is in large part why the government has been able to report such fiscal strength,” said Alex Joiner, chief economist at Ifm Investors Pty Ltd. The government is expected to post a record budget surplus of A$20 billion in the 12 months through June.

The key remains the outlook for inflation. If Australian policymakers reckon they’re unlikely to meet their goal of being inside the target by late 2025, then they may hike again.

RBA Governor Philip Lowe delivered his final testimony to lawmakers in Canberra on Friday, where he kept the central bank’s options open on further tightening amid worries over sticky services prices. Lowe will hand over to Deputy Governor Michele Bullock next month.

Read more: RBA Governor Says Policy Has Now Entered ‘Calibration Phase’

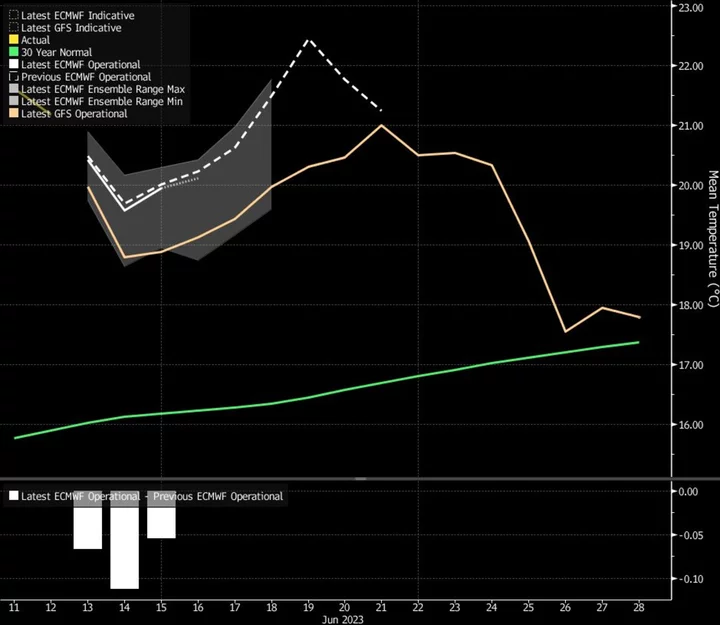

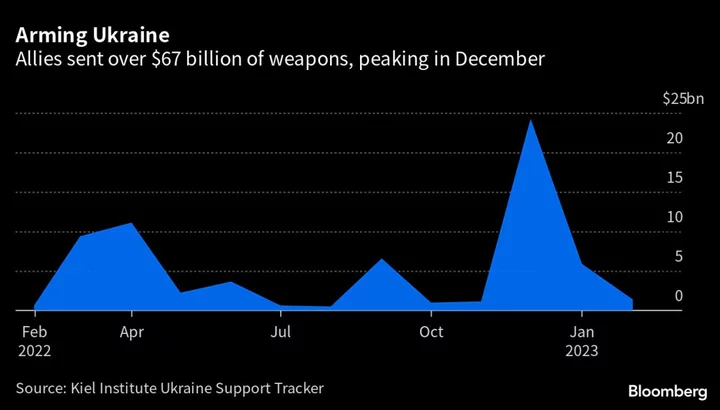

Micaela Fuchila, an economist at Bank of America, reckons Australia will also see an uptick in inflation from El Nino weather boosting food prices, higher oil and the fallout from Russia’s war on Ukraine. “A weaker Australian dollar would make it hard for the RBA to reach the inflation target,” she said.

--With assistance from Michael G. Wilson.

(Adds RBA governor’s testimony in penultimate paragraph.)