Singapore’s rental price growth slowed in the second quarter, cooling a years-long boom that has sapped affordability and threatened to dent the city-state’s appeal as a finance hub.

An index of private residential prices rose 2.8% from the previous three months, the smallest gain since 2021, Urban Redevelopment Authority figures show.

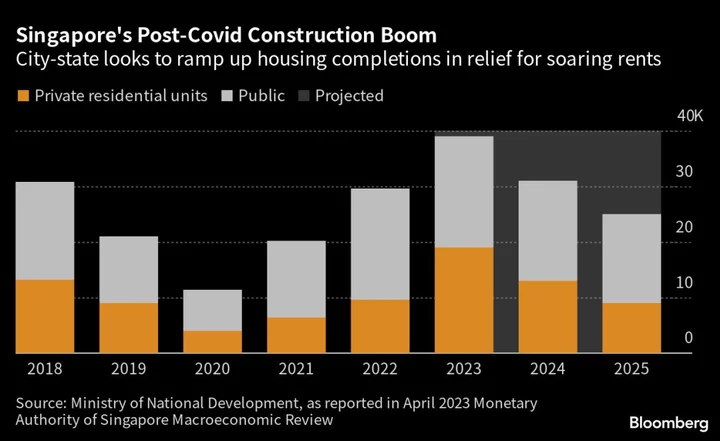

The growth in rental costs is expected to ease further as new units become available, with about 20,000 private housing completions due this year alone — the highest annual supply since 2017. Government measures have also helped relieve the spike in rents that has rattled tenants.

“Even expatriates with accommodation allowances were reconsidering their leasing options, as the cost of living in Singapore had grown exceptionally,” said Nicholas Keong, head of residential and private office at Knight Frank Singapore. He expects rental prices to further ease in the remainder of 2023 with “the steady completion of new inventory.”

Read More: Singapore Home Prices Fell for the First Time in Three Years

Island-wide leasing contracts for private apartments over the past three months were at the lowest since the start of the pandemic, with April and May volumes down 9.2% from a year ago, according to Knight Frank.

The high-end market, in particular, has seen the biggest reversal. Rents in the ultra-luxury segment slumped almost 4% in the second quarter, against the 9% gain in the previous quarter, according to Knight Frank’s analysis of Urban Redevelopment Authority data.

Property agents have been feeling the pinch. Sunita Gill, co-founder of real estate consultancy Singapore Luxury Homes, has seen some of her expat clients relocate to Dubai. The government’s latest cooling measures — doubling stamp duties for foreigners to 60% — has also deterred potential investors, leading to lower demand for luxury rentals, she said.

“We’re personally witnessing a 10-15% reduction for properties listed for more than two months,” said Gill. “The luxury real estate market in Singapore may have become saturated recently with an abundance of high-end properties available for rent.”

Since the pandemic, the city-state has largely defied a global property slowdown as an influx of wealth from China and other countries fanned the market. Singapore tied with New York for the city with the fastest pace of rental growth at one point last year, and recently slid to second spot.

Meanwhile, discontent over renting costs has become a political problem. Although rental hikes have impacted expats more acutely since they are less likely to own homes, a survey last year showed that two in three Singaporeans between the ages of 22 to 29 are choosing to rent due to insufficient savings. In July, a YouGov poll found that over half of respondents think the government needs do more to regulate rents and provide additional support based on income.

Rents for private apartments rose 0.3% in June from a month earlier, according to a report by real estate portal SRX. Mark Yip, chief executive officer of property agency Huttons Group, expects rents of private apartments to increase between 10% to 15% this year, moderating from the almost 30% increase in 2022.

“For renters in Singapore, relief is in the air,” said Alan Cheong, executive director of research at Savills Plc.

(Updates with chart on rental price change)