Swedish landlord SBB has attracted interest from investors including Brookfield Asset Management, as the property tycoon at the center of country’s real estate crisis faces an uphill battle to save his $13 billion empire.

The Canadian investment group is among investors involved in early stage talks with Samhallsbyggnadsbolaget i Norden AB to evaluate the real estate firm’s portfolio, said the people, who asked not to be identified as the meetings weren’t public.

Signs of interest come after Ilija Batljan, SBB’s founder and chief executive, traveled to the City of London this week and spoke to a number of investors about selling individual assets as well as the whole company, said another person familiar with the process.

Analysts see a full sale unlikely and buyer interest is expected to focus on assets such as SBB’s elderly care homes and residential units. The company’s dwindling prospects have also raised political concern, given its ownership of many public-sector buildings.

A representative for the Stockholm-based company declined to comment on the process when contacted by Bloomberg News. Brookfield also declined to comment.

The window for SBB to find cash continues to narrow with the share price slumping a further 30% this week to close at its lowest level since its stock market debut in 2017. The embattled CEO has already paused some hybrid bond coupons, scrapped a dividend and emergency rights issue and has even hired the services of JPMorgan Chase & Co and SEB AB to drum up some support.

“Selling the entire company is quite unlikely,” Michael Johansson, a real estate analyst at Arctic Securities, said in an interview. “I don’t think you’re particularly interested in being responsible for all the unsecured bond debt and hybrids, especially considering how they are traded in the secondary market.”

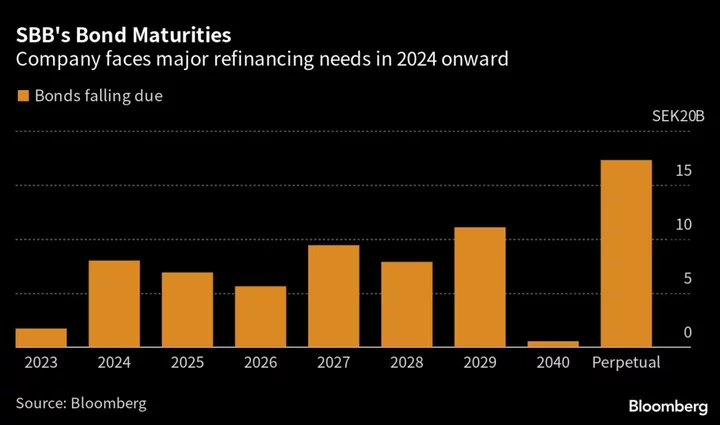

With an $8 billion debt pile and surging interest costs, the company has so far failed to shore up investor confidence. Over the next three years, SBB must roll over $1.6 billion of maturing bonds, making it a test case for European property companies that have borrowed heavily in the era of easy money.

Read More: Sweden Wrestles With an Economic Crisis Built at Home

Adding to the signs of tension, the investment firm owned by SBB’s outspoken founder announced late Thursday that it will postpone the publication of its quarterly report to June 9 from May 31. Ilija Batljan Invest AB recently skipped interest payments on its hybrid bonds.

SBB’s highly leveraged and complex balance sheet continues to attract short sellers and confound analysts. It’s the reason a full-blown acquisition of the firm looks like a tall order.

That leaves a ramp up of asset sales as the next best alternative but selling into the current choppy market could put valuations at risk, according to Mary Pollock, an analyst at research provider CreditSights.

“If SBB sells at fire-sale discounts, then it risks setting a new comp for the rest of its portfolio and, in turn, having to write-down considerably more assets,” she said.

Pollock says the picture around what assets will be sold isn’t clear but buying interest could focus on SBB’s nursing homes, healthcare properties and chunks of the residential portfolio, “in line with what the company had already indicated with the IPO of Sveafastigheter.”

SBB’s empire spans more than 2,000 properties across the Nordic region. Before the funding crunch hit Sweden — home to one of the world’s worst property routs — the company had pursued aggressive growth by snapping up social housing and municipal buildings from cash-strapped authorities and leasing them back.

Read More: Swedish Home Prices Continue Downward Trend as Rate Hikes Bite

With much of the portfolio comprising community-service properties, the deepening crisis at SBB has come to the attention of Swedish lawmakers. The Left and Green parties have publicly said the state should be first in line to buy properties from the company, while the government has sounded out potential asset buyers for public properties, business daily Dagens Industri recently reported, citing unidentified sources.

Tension is now building ahead of an extraordinary general meeting to approve emergency cash-savings measures on June 14. If the CEO fails to present a credible path forward the next step for SBB and its long suffering shareholders could be even more painful.

“In the worst case, we cannot rule out SBB being mismanaged into a restructuring,” Pollock at CreditSights said.

Author: Laura Benitez, Anton Wilen and Jack Sidders