Doosan Robotics Inc. more than doubled in its trading debut in Seoul after raising 421 billion won ($309 million) in South Korea’s largest initial public offering this year.

Shares of the robot maker surged as much as 160% to 67,600 won in early trading on Thursday. The company, with Seoul-listed Doosan Co. as its biggest shareholder, last month sold 16.2 million shares at 26,000 won each, the top of a marketed price range.

The debut signals strong investor appetite for the sector in tech-savvy South Korea, which is the world’s top robot adopter, employing 10 manufacturing workers for every industrial robot. Shares in robotics makers are among the country’s most sought after this year as the government and local companies, including Samsung Electronics Co., stepped up investments.

Read: Beer-Serving Robots Drive Robust Demand for Korea’s Biggest IPO

Since Doosan Robotics announced its plan to go public, its parent company and peers such as Kosdaq-listed startup Rainbow Robotics have seen their stocks surge amid demand from domestic investors. The shares could jump when it starts trading, said Douglas Kim, an analyst who publishes on the SmartKarma platform, said before the trading debut.

Companies that raised at least $100 million in new share sales in South Korea over the past five years jumped by an average 57% in their first day of trade. Apart from Doosan Robotics, only one other company this year has raised more than that amount through an initial public offering in Seoul.

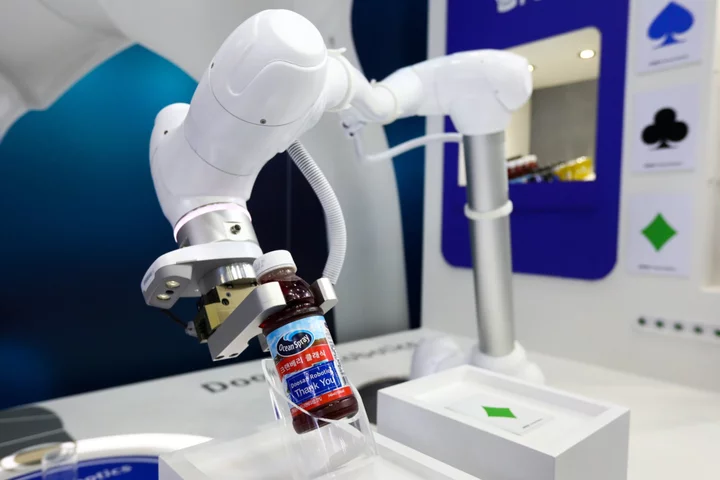

Founded in 2015, Doosan Robotics specializes in robotic arms that work alongside humans on tasks beyond factory floors. The machines have been deployed in a wide range of services from making coffee and deep fried chicken to serving beer and handling luggage at an airport.

Doosan Robotics plans to use the IPO proceeds for strategic acquisitions and overseas expansion, Chief Executive Officer Ryu Junghoon said in an interview. It’s considering acquiring a firm with technology that could give robots mobility, he added. The company garnered sales of 45 billion won in 2022 from customers including Hyundai Motor Co. and LG Electronics Inc.

Mirae Asset Securities Co. and Korea Investment & Securities Co. are lead-managers of the IPO.

--With assistance from Shinhye Kang.

Author: Filipe Pacheco, Youkyung Lee and Yoolim Lee