Even after a record stretch of asset sales that total at least $6.6 billion in just two years, financial markets are indicating that Fosun International Ltd. will need to do more to weather China’s economic downturn.

The company’s shares have fallen 26% this year after touching the lowest in a decade last week, compared with a decline of about 11% for the benchmark Hang Seng Index. Despite some positive signals from the bond market, its longer-term securities still trade at distressed levels.

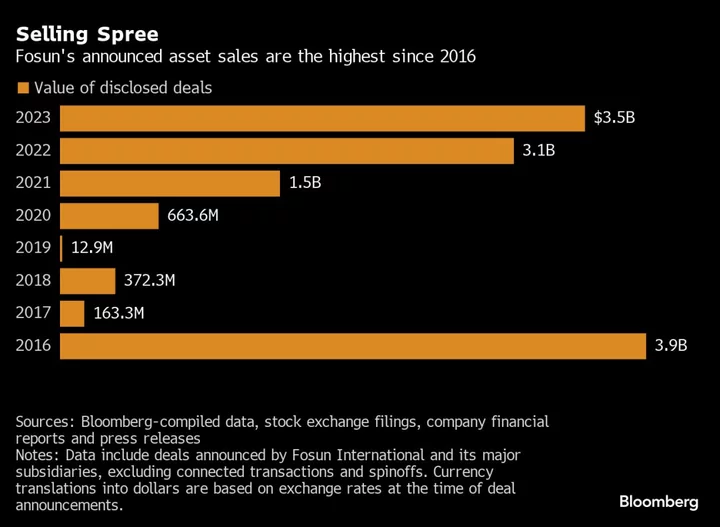

The group — whose businesses span tourism, pharmaceuticals and finance — accelerated its asset sales late last year to pare debt as credit concerns triggered a bond and stock selloff. It’s announced $3.5 billion of planned divestitures this year, the most since 2016. Combined with last year’s total, the disposals amount to the most for any two-year stretch, according to data compiled by Bloomberg.

But the flurry of sales by billionaire founder Guo Guangchang’s conglomerate slowed in recent months, with no major disposals announced since July. The planned sale of Fosun’s 60% stake in Nanjing Nangang Iron & Steel United Co. for $2 billion, among its largest-ever announced divestitures, has also been dragged down by litigation that was only settled last month.

A Fosun spokesperson didn’t comment on the company’s share slump. The spokesperson said that even though debt maturities were among the company’s largest ever in 2023, it has “repaid the debt via dividend contributions from subsidiaries, asset divestment and refinancing.”

“The company maintained its cash buffer,” the spokesperson said. “Fosun has diversified financing channels and maintains an extensive collaboration network with domestic and foreign banks.”

Without big-ticket asset sales as a catalyst, investors are stepping up scrutiny on Fosun’s ability to stave off the malaise of China’s slowdown stemming from regulatory crackdowns and a property crisis. Due to its wide-ranging business interests, the group is particularly sensitive to the country’s economic performance, which has remained weak amid tepid consumer sentiment, subpar industrial output and high borrowing costs.

“What Fosun faces is a very hostile environment,” said Vincent Lam, chief investment officer at Hong Kong-based VL Asset Management Ltd. “More asset sales seem to be necessary” to streamline the group’s operations and obtain more capital, though the firm should be able to manage that in an orderly fashion, he said.

While Fosun has managed its debt wall, mainly with substantial asset sales, its liquidity is less than adequate due to a shortfall in cash on hand relative to short-term maturities, S&P Global Ratings said in a September report. The company will need to maintain a good relationship with banks and continue to sell assets to boost cash, but possible divestments face “meaningful execution uncertainties,” the firm said.

Fosun announced on Tuesday that its application for a proposed spinoff and separate listing for Portuguese hospital operator Luz Saude SA was approved by the Hong Kong Stock Exchange. The listing on Euronext Lisbon will involve a private placement of the operator’s newly issued shares and an offer for sale of existing Luz Saude shares by Fidelidade, a Portuguese insurer controlled by Fosun, the group said in a filing.

A sense of optimism has returned to parts of the credit market recently after some successful financings. Fosun’s four dollar bonds had their best gains last week in several months. The group’s note due 2024, for example, jumped 4 cents, its biggest advance since January, and were last at about 94.7 cents. Its securities due 2025 rose 5.5 cents and were last at 83.

In October, a Fosun unit sold a 700 million yuan ($98 million) two-year mid-term note — its first domestic bond with a tenor of over one year, a sign that the onshore credit market refinancing channel is reopening for the firm.

And more recently, Fosun International received over €400 million in commitments for a loan with a greenshoe option to upsize to €600 million, to refinance another loan, a person familiar with the matter said. In addition, Fosun Industrial Co., a subsidiary of Shanghai Fosun Pharmaceutical Group Co., recently got a €230 million loan that was upsized from €200 million due to market demand.

But the picture gets more complicated in the longer term for Fosun, whose holdings include resort chain Club Med SAS and stakes in 16 public companies like luxury fashion house Lanvin Group Holdings Ltd.

Fosun’s bonds due in 2026 and 2027 also rallied last week. But their prices are still at about 73.3 cents and 67 cents respectively with spreads above 1,000 basis points, highlighting creditor concerns further down the line. Generally global investors consider bonds below 80 cents on the dollar with spreads above 1,000 basis points to be distressed.

“Given the concerns around China’s growth and high defaults in the real estate sector, there’s now what we believe a China discount being applied to companies such as Fosun,” said Dhiraj Bajaj, Lombard Odier (Singapore) Ltd.’s head of Asian fixed income.

The conglomerate survived a state crackdown on debt-fueled expansion last decade as peer HNA Group collapsed and Dalian Wanda Group Co. became much-more domestically focused.

Guo said during an August earnings briefing that expansion will no longer be Fosun’s main growth strategy because of soaring borrowing costs. He added the group will instead focus on improving existing businesses while continuing to sell assets and reduce debt.

--With assistance from Fion Li, Venus Feng, John Cheng and Dorothy Ma.

(Updates to add announcement by Fosun in 10th paragraph.)