The Qatar Investment Authority is poised to buy a minority stake in the group that owns Washington franchises in the NBA, WNBA and NHL in a groundbreaking move by a sovereign wealth fund into US pro sports, the Washington Post reported Thursday.

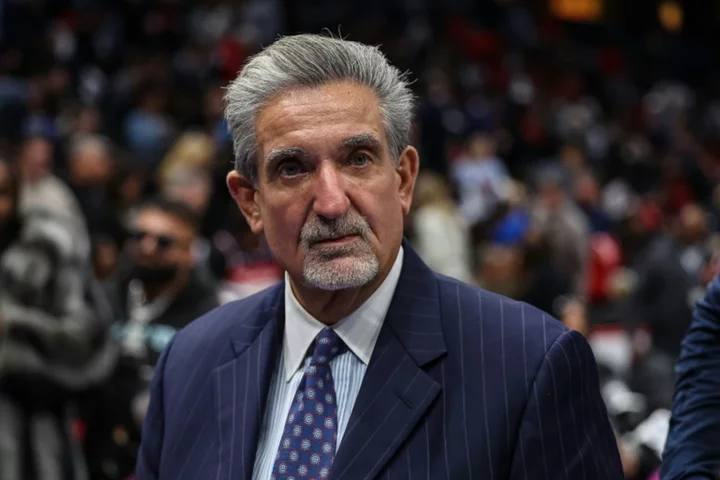

The Post was one of several US media outlets reporting that the state-owned Qatari fund was seeking to acquire a 5% stake in Monumental Sports & Entertainment, the group headed by Ted Leonsis that owns the NBA's Washington Wizards, the WNBA's Mystics and the NHL's Capitals.

If the deal goes through, the QIA would become the first sovereign wealth fund to own part of a major US team sports club.

The Post cited a person familiar with the terms, and the NBA confirmed it was reviewing the investment, which has yet to be finalized.

The NBA tweaked its rules last year to allow for such foreign investment, although no fund is allowed to own more than 20% of a team.

"The NBA Board is currently reviewing a potential investment by QIA in Monumental Sports & Entertainment, the parent company of the Washington Wizards, among other sports properties," NBA spokesman Mike Bass said in a statement quoted by US media.

"In accordance with the policy, if approved, QIA would have a passive, minority investment in the team, with no involvement in its operations or decision-making."

The Athletic cited a "high ranking NHL source" in saying the league has never precluded investment by a sovereign wealth fund. Acquisition of a stake in a team does require approval from the league's board of governors, and the Athletic reported that the executive committee of the board has already signed off on the sale.

Speaking last week on "The Dan Patrick Show" syndicated talk show, NBA commissioner Adam Silver spoke about state investment in sports and when discussing the financial deal between the PGA Tour and the Saudi Arabian Public Investment Fund, which backed the breakaway LIF Golf circuit.

"When the Saudis invest in sports, it gets outsized attention," Silver said. "Now, I don't want to complain about that because we want to get outsized attention. On the other hand, somebody could go down the list there. They are investors in some of our largest American corporations. Some of the most well-known brands have investments from them. And I also think it's a two-edged sword.

"I hear the comments about sportswashing. On the other hand, you're talking about it, others are talking about it.

"In the same way, the World Cup — the football World Cup, soccer World Cup — brought enormous attention to Qatar. I think people learn about these countries, learn about what's happening in the world in ways they otherwise wouldn't."

- Widespread sports investment -

Qatar has made heavy investments in global sport over the past decade. Qatar Sports Investments, owners of French champions Paris Saint-Germain, are in negotiations over acquiring a stake in Italian football club Sampdoria, a source told AFP last month.

QSI has owned the French club since 2011, transforming it from a struggling outfit into one of the most powerful in Europe with QSI president Nasser al-Khelaifi also serving as president of PSG.

It also owns a 22% stake in top Portuguese club Braga.

Qatar hosted the World Cup last year, when the country's treatment of migrant workers and its human rights record dominated pre-tournament headlines.

bb/rcw