The market for new preferred shares in the US is reopening after a near half-year freeze, raising hopes that this crucial source of capital — especially for the nation’s major lenders — is returning to normal.

Money manager Apollo Global Management Inc. is offering $250 million of preferreds on Wednesday, following Goldman Sachs Group Inc., which raised $1.5 billion of its own on Monday, and Wells Fargo & Co., which recently replaced a divisive security.

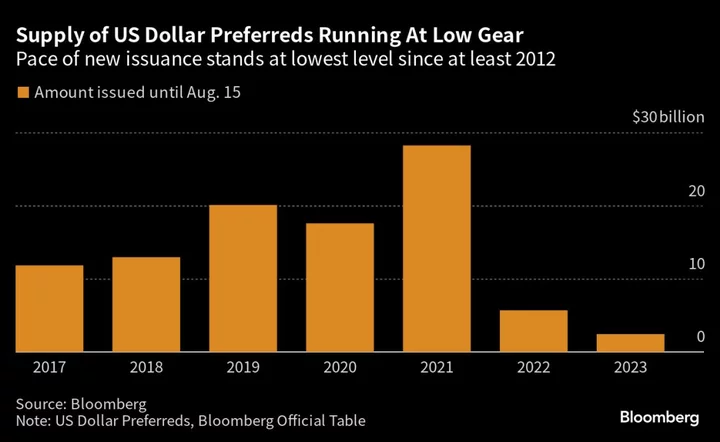

The new issues mark the return of sizable deals in the primary market for preferred shares, after the collapse of Silicon Valley Bank and Credit Suisse’s demise sent ripples through the market for subordinated securities globally. After about five months without any eye-catching issuance, some household names are once again seeing a window to sell new preferred shares.

“The cash sitting on the sidelines has to be invested and issuers have to issue,” said Allen Hassan, head of preferred-stock trading at Ziegler Capital Markets. “There has to be more confidence in the market since, up to now, you’ve had a lack of supply and lack of conviction on the buyside.”

Investors are drawn to preferreds because of the beefy yields offered by companies as compensation for the securities being subordinate to all types of debt and having an uncertain time frame for repayment. The lack of new offerings of preferred shares for the past few months — as banking woes drove borrowing costs higher — left a hole in the market. Despite an active secondary market, new issuance remains the venue to buy preferred shares in bulk.

Banks in the US can sell them to raise — or replace — core capital, while companies in other sectors tend to use them to pad their balance sheets and bolster credit ratings. This became harder after yields rose earlier this year, but borrowing costs are now at levels that make it worthwhile for some to come to the market.

Most banks also stood on the sidelines from issuing preferred shares because they expected the Federal Reserve to cut interest rates, said Jesse Rosenthal, head of US financials at CreditSights Inc. But now that the market has settled into a higher-for-longer rate environment, banks are encouraged to refinance their preferreds to lock in a lower rate.

“The thought was that maybe rates would have peaked by now, but instead it just keeps on getting extended,” said Arnold Kakuda, senior credit analyst at Bloomberg Intelligence. “So maybe some are throwing in the towel and saying rates are going to remain elevated, let’s just do this now.”

Goldman Sachs sold a perpetual callable after five years at 7.5% in order to repay an older issue currently paying 9.27%. Indications of interest for the note amounted to $6.25 billion, according to data compiled by Bloomberg.

Last week, Wells Fargo completed the refinancing of a note that divided opinion on Wall Street back in May, as some banks made unexpected decisions while shifting away from Libor, which was phased out at the end of June.

The San Francisco-based lender’s new issue came at 7.625% against a fixed-for-life rate that would have been almost 9% in the replaced series.

Still, preferred shares are yet to recover fully from the turmoil earlier this year. The net asset value of a preferred-focused exchange-traded fund by BlackRock’s iShares remains below pre-SVB levels and only marginally higher since the start of the year.

But the budding preferred-issuance revival could open up further money-making opportunities, encouraging more investors to weigh in.

“August has been busier than expected and the fourth quarter will be interesting,” said Ziegler’s Hassan. “You probably need the smart guys to make a lot of money before more people start to jump in.”