Polish banks suffered a defeat at the European Union’s top court, allowing thousands of customers to avoid paying interest on Swiss franc-based mortgages that were deemed unfair by local judges. Lenders’ stocks pared losses after falling as much as 2.5%.

The rulings are part of a decade-long saga that has led to more than 130,000 lawsuits in Polish courts by disgruntled mortgage holders over potentially “abusive” terms in their contracts, and how to settle payments when the loans get annulled.

The row has triggered billions of dollars in provisions, weakening the valuations of Polish banks, and the latest ruling is set to fuel additional write-offs. The country’s banking lobby fumed at the verdict, while a central bank official played it down.

When foreign-currency mortgage loan contracts are annulled due to unfair terms, “EU law does not preclude” customers “from seeking compensation from the bank going beyond reimbursement of the monthly installments paid,” the EU Court of Justice said in a binding ruling. “By contrast, it precludes the bank from relying on similar claims against consumers.”

In a separate dispute over the controversial loans, the Luxembourg-based EU judges said Polish courts can’t refuse customers a suspension of their obligation to make monthly mortgage payments — as a protective measure — in pending disputes over unfair terms in their contracts.

Warsaw’s WIG-Bank index traded 0.9% lower as of 12:56 p.m. in the Polish capital, while the zloty was 0.4% weaker against the euro.

Despite the legal risks and Thursday’s dip, banks have performed better than Warsaw’s benchmark WIG20 index in 2023 as lenders’ profits surged to all-time highs following a steep increase in official borrowing costs.

Monetary Policy Council member Przemyslaw Litwiniuk said the ruling was anticipated and “not groundbreaking” for the industry. “It generally confirms EU standards of consumer protection,” he told TOK FM radio. “The verdict reduces risk for borrowers more than it creates new risk.”

Read More: Polish Banks Are at a Turning Point With Franc Loans: QuickTake

Poland’s financial regulator said the ruling was negative for the country’s well-capitalized banks and the economy. It called on lenders to include the impact of the verdict in their provision models and said that out-of-court settlements remain the best way to resolve the issue.

“Settlements are the most attractive and rational alternative to a costly and lengthy legal path,” the regulator said in a statement.

Lenders have long argued that barring them from passing on costs means clients basically get interest-free mortgages, which could lead to even more lawsuits, which would in turn force them to boost provisions.

Borrowers have fought against further remunerations for banks, beyond the nominal value of the loan. They’ve argued that banks should get some penalty for applying “abusive” clauses in contracts — enabling lenders to arbitrarily set foreign exchange rates — to prevent further such scenarios in the future.

Poland’s main banking lobby group said the verdict would lead to a “significant” decline in lending and was a “huge blow” for lenders, although it won’t dent the sector’s stability.

“The ruling creates a situation when a group of clients receive loans practically for free,” said Tadeusz Bialek, head of the banking association. “It radically and unjustifiably favors a narrow group of borrowers” who took out loans in foreign currencies instead of the zloty.

Financial Engineering

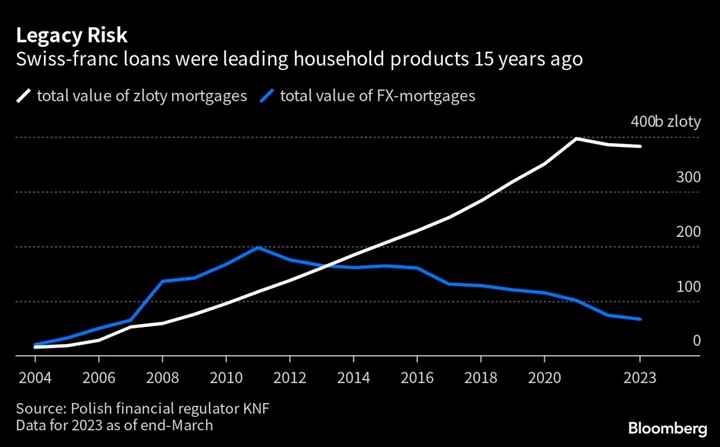

At the heart of the issue is what seemed like a clever piece of financial engineering to sell more mortgages before the 2008 crisis. Assuming that the zloty would indefinitely maintain its value-increasing run, mortgage holders were offered home loans indexed to the Swiss franc, with the benefit of lower interest rates than mortgages in the local currency. Poland, which was dealing with a lack of homes, became most exposed in Europe.

When markets turned in the wake of the global banking meltdown, the equation no longer worked. Polish borrowers sued for refunds after the depreciation of the zloty boosted the value of their loans, often to more than that of the property.

A landmark ruling by EU’s top court in 2019 paved the way for the annulment of contracts that included unfair terms. After writing off about $10 billion of sour mortgage portfolios, Polish banks still face legal issues stemming from $10.8 billion worth of outstanding Swiss-franc home loans.

Polish lenders need to boost provisions by another 60 billion zloty ($14.6 billion) to resolve the issue, according to Tomasz Noetzel, a senior emerging-market bank analyst at Bloomberg Intelligence. He expects sentiment to be weak as lending and dividends take a hit.

In the last two years, Polish banks have converted more than 60,000 FX-mortgages to zloty loans via voluntary settlements with clients in a bid to reduce risk. Still, about 300,000 clients remain with Swiss-franc debt.

While the Polish financial regulator warned last year that a negative verdict in the latest case may boost banks’ losses to as much as 100 billion zloty, growing profits from high interest rates have made lenders more sanguine about potential outcome. It’s also fueled a rally on banking stocks.

The cases are: C-520/21, Bank M. (Consequences de l’annulation du contrat); C-287/22, Getin Noble Bank (Suspension de l’execution d’un contrat de credit).

--With assistance from Steven Arons, Piotr Skolimowski, Wojciech Moskwa, Piotr Bujnicki, Konrad Krasuski and Andras Gergely.

(Updates with latest market developments from the first paragraph.)