A $5.5 billion selloff in Ping An Insurance Group Co. is underscoring why a mooted takeover of distressed developer Country Garden Holdings Co. would be perilous for both the insurer and the Chinese financial system.

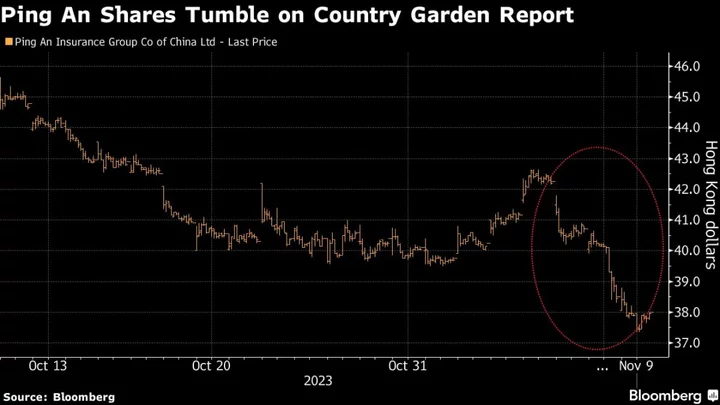

Ping An has repeatedly denied a Reuters report on Wednesday that Chinese authorities asked the company to buy Country Garden — and analysts have put low odds on a deal materializing. Yet even the outside chance of a rescue has sent Ping An shares tumbling almost 7% over the past two sessions to the lowest level in a year.

The market’s response offers a fresh reminder of why a Ping An-Country Garden combination might cause more problems than it solves. Such a deal would likely raise questions about the resulting strength of Ping An’s balance sheet, risking a collapse of confidence in an insurer that has 11 trillion yuan ($1.5 trillion) of total assets and 227 million of retail customers across China.

Past takeovers of large and troubled companies in China have tended to be led by state-owned firms with strong backing from the national government in case losses snowball. History suggests there’s reason to be cautious, given that Ping An’s investment in China Fortune Land Development Co. wiped out about 24 billion yuan of its profit in 2021.

“Investors are worried that Ping An is being asked once more to clean up a mess, much like it did with China Fortune Land, which ended up being a huge drain on its finances,” said Li Xuetong, fund manager at Shenzhen Enjoy Investment Management Co. “Any investment may take down Ping An,” given the depressed valuation of Chinese property assets, he added.

Ping An’s exposure to the property sector stood at about 4.5% of its total investments at end-September, compared with about 5.5% in 2021, according to a report from Nomura Holdings Inc. The insurer has been reducing its real estate holdings, and people with knowledge of the matter said the firm sold its stake in Country Garden last quarter.

The insurer is trading at 0.7 times book value, compared with 0.1 times for Country Garden, according to data compiled by Bloomberg. Ping An’s shares have dropped more than 26% this year, more than twice the decline recorded by the benchmark Hang Seng Index.

Ping An may have no obligation or intention to take over the property company “considering that it has already cut its position in Country Garden,” Nomura analysts including Shengbo Tang wrote in a note. “It has also controlled its overall exposure to real estate which shows that it has learned a lesson from its investments in China Fortune Land.”