Bearishness among foreign investors toward China’s bonds is easing after last year’s rout, with Pacific Investment Management Co. becoming the latest to warm up to the debt.

“We have turned neutral on China bonds for a number of weeks now, compared with an underweight bias at the beginning of the year,” said Stephen Chang, a portfolio manager at Pimco. “Data continue to show the Chinese economy losing momentum and the current monetary policy justifies a more neutral stance for us on duration.” Easing depreciation pressure on the yuan is also supportive, he added.

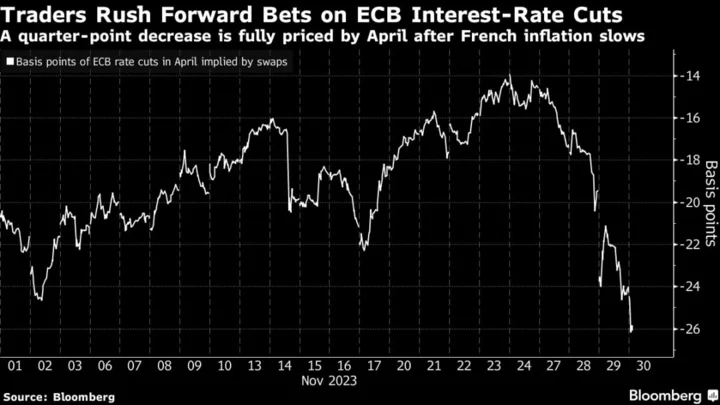

After a record exodus last year, global funds have started returning to Chinese bonds since May as bets for US interest rates to soon peak and Beijing’s monetary easing boost demand. But optimism has yet to fully take hold, with pricey valuations, a wide US-China yield gap and uncertainties over the yuan’s outlook deterring some investors.

It may take some time for sentiment toward China’s economy to recover completely, even after the Politburo, the country’s top decision-making body, adopted a supportive stance toward the private sector and housing market at its latest meeting, Chang said.

“It’s a matter of where those policies will come through — not only in terms of the exact measures, but also in terms of the timing of when they might become helpful,” he said. “While there is that desire to support growth for it to go back up as the Politburo signaled, the type of measures might be more difficult to implement this time around.”

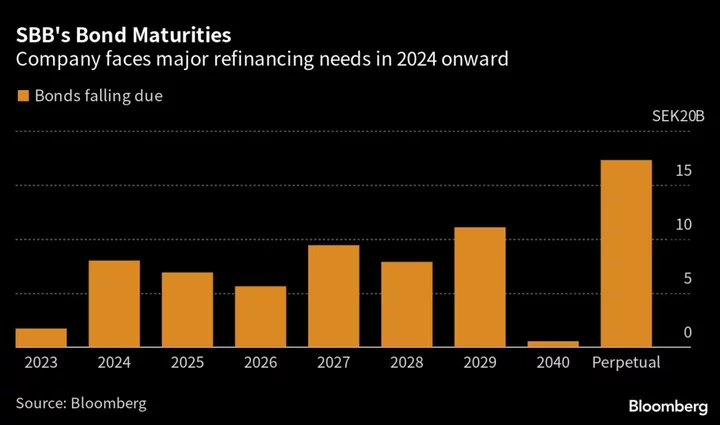

The probability is also low for a meaningful rebound in Chinese property bonds. “Many Chinese developers will be facing maturity coming through in the next 6 to 12 months and their ability to meet timely payment of those bonds remains vulnerable,” Chang said.

Pimco is holding more of a neutral view on developers’ dollar notes, until industry support measures lead to a pickup in actual home purchases that would improve companies’ cash flows and credit profiles, he said.

While China’s economic fundamentals and policy direction bode well for its local-currency debt, the nation’s sovereign bonds remain expensive on a valuation basis, reducing its appeal relative to other government bond markets, according to Chang.

China’s yield curve is likely to steepen as potential further easing measures pressure the front end while extra bond supply points to lower conviction on longer tenors, he said.

The 10-year government bond yield has fallen since February and touched the lowest in almost a year this month. A gauge of China manufacturing rose slightly in July but remained in contraction territory for a fourth month, according to data released on Monday.

Here are some other takeaways from the interview:

- There may be quite incremental and modest rate cuts in China in terms of scope, but at least the direction is that the central bank will keep monetary policy accommodative

- If the yuan were to stabilize and maybe even turn around from the recent depreciation, that may be a potential supportive factor for allocation to China bonds. The recent yuan fixings indicate that the PBOC may not want to see additional weakness. The CFETS Index for the currency may stabilize at current levels after the pullback this year

- In Asia, Pimco is overweight South Korea due to the country’s preemptive rate hikes and stabilizing inflation; underweight Malaysia where rate hikes have been slow compared to other economies

(Updates with China PMI in the last paragraph)