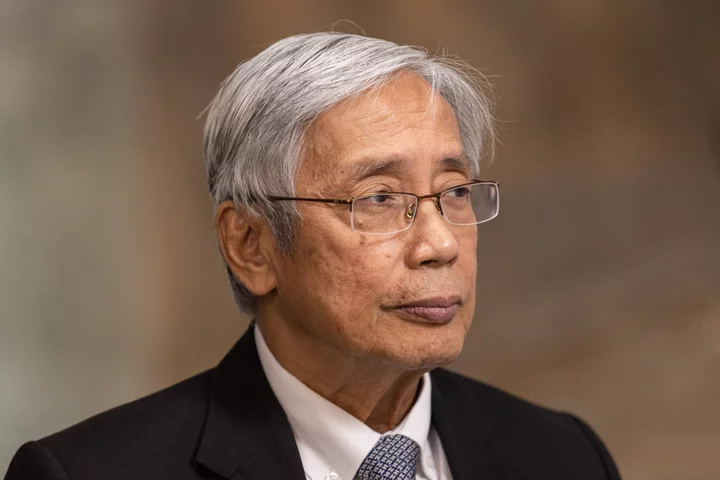

The Philippine central bank is reducing lenders’ reserve requirement ratio at the end of the month, Governor Felipe Medalla said, as he signaled the policy rate will remain unchanged.

Bangko Sentral ng Pilipinas will trim reserve requirement of big banks by 250 basis points to 9.5%, effective June 30, it said in a statement Thursday. The ratio for digital banks will be reduced by 200 basis points to 6% while that for thrift banks will be cut by 100 basis points to 2%, it said.

The central bank said the lower reserve requirements “do not constitute any shift in the BSP’s monetary policy settings.” The reduction will coincide with end of alternative modes of compliance with reserve requirement, it said.

Medalla said monetary authorities may keep the key rate at the current level of 6.25% after halting its fastest monetary tightening in two decades last month. “My own view is that the pause is very likely to continue because the recent data is consistent with it,” he told reporters. The central bank’s Monetary Board will hold its next policy meeting on June 22.

BSP said it “continues to prioritize bringing inflation back towards a target-consistent path over the medium term and will continue to signal its monetary policy stance through the key policy interest rate.”

The reduction in reserve requirement for large banks will release about 325 billion pesos ($5.8 billion) into the financial system, which can be used for lending, said Michael Ricafort, chief economist at Rizal Commercial Banking Corp. The central bank is likely to offset the additional cash through the sale of more bills, with the launch of a 56-day tenor on June 30, since any excess money could fuel inflation or destabilize the peso, he said.

Medalla had earlier flagged the planned reduction in banks’ reserve ratio, which currently stands at 12% for large lenders. Last month, he also signaled an extended pause on interest rates amid easing inflation and a slowing economy.

As to when the central bank can start cutting its key rate, Medalla said the decision depends on whether or not inflation is “very firmly” within BSP’s target of 2%-4%.

“If inflation is low, the consideration of exchange rate effect becomes weaker and that could result in a cut before end of the year,” he said. “If inflation is near edge of target, we can’t ignore potential exchange rate effects of rate cuts.”

Inflation may ease to below 4% by September or October, as earlier forecast by the central bank, should the trend of slowing price gains continue, he said.

--With assistance from Cecilia Yap and Claire Jiao.

(Adds quotes from Medalla, economist.)