The Philippine central bank will probably keep its benchmark interest rate steady for the rest of the year to ensure that prices have cooled sufficiently before considering monetary easing in 2024, according to the governor whose term is ending on July 3.

“Waiting is the better strategy. Maybe the optimal waiting time is up to January or February if current conditions remain,” Governor Felipe Medalla said in interview with Bloomberg Television’s David Ingles and Yvonne Man on Friday when asked about his rate cut outlook. The first two months of 2024 “will be a good time to say that we have room to cut,” he said.

Medalla, 73, wasn’t confident of being reappointed by President Ferdinand Marcos Jr. while stressing that whoever is tapped as as the next governor will do the right thing, fulfill the price stability mandate of Bangko Sentral ng Pilipinas and preserve its independence.

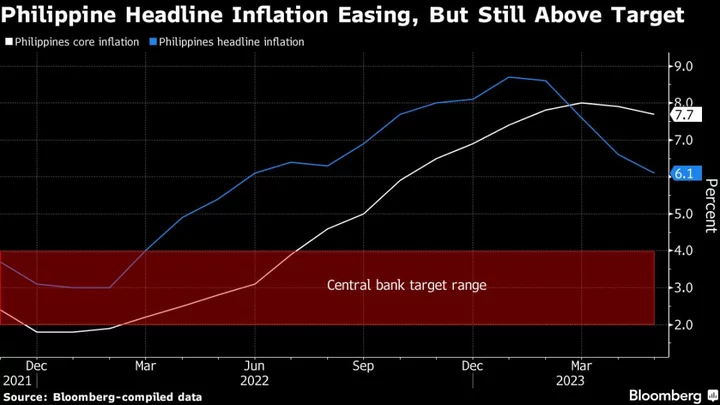

The BSP has done enough after 425 basis points of hikes in the past year, according to Medalla and won’t need to match any further rate hikes by the Federal Reserve if it stays within quarter-point moves. At this point, the Philippines has “little reason to raise and there’s little reason to cut.” It held the key rate at 6.25% at Thursday’s meeting.

The governor who presided over the Philippines’ most-aggressive monetary tightening in two decades to rein in the fastest inflation in 14 years said he would like to see continued reforms in capital markets and the payments system.

A longtime economics professor, Medalla took the helm as governor a year ago to continue the remaining term of Finance Secretary Benjamin Diokno.

Barely two weeks into his appointment last year, the BSP decided on an out-of-schedule rate hike in July, reacting to US data showing quicker inflation. On Nov. 3, he announced that BSP will match the Fed’s 75-basis-point hike, to take effect two weeks later to help support a peso that slumped to a record low weeks before.

Philippine inflation has cooled for four months in a row in May although still above the 2%-4% target, while the currency is among the better performers against the dollar this month.

“It’s an honor to serve,” Medalla said. “I’ve no doubt monetary policy will continue the way it has continued from one governor to the next,” citing the institutions well-carved out mandate and its people.

--With assistance from Cecilia Yap and Andy Clarke.