PetroChina Co.’s profits rose 21% in the third quarter as increased output offset headwinds from lower oil prices and the nation’s lackluster economic recovery.

Net income for China’s biggest oil company rose to 46.38 billion yuan ($6.3 billion), from 37.9 billion yuan a year earlier, according to an exchange filing on Monday. That followed a record profit in the first half as the company increased output even as China’s post-virus recovery disappointed.

PetroChina’s revenue slipped 4.6%. Global benchmark Brent crude jumped by more than a quarter in the three months through September, but was still around 12% lower on average than in the same period in 2022.

Total oil and gas output rose 5% to 1.3 billion barrels in the first nine months, compared to 1.25 billion barrels a year earlier. It has a goal of raising annual production to 1.73 billion barrels for this year.

PetroChina has been a key beneficiary of discounted crude from Russia, as well as Beijing’s policy to relax natural gas price controls to enable companies to pass on price increases to end-users.

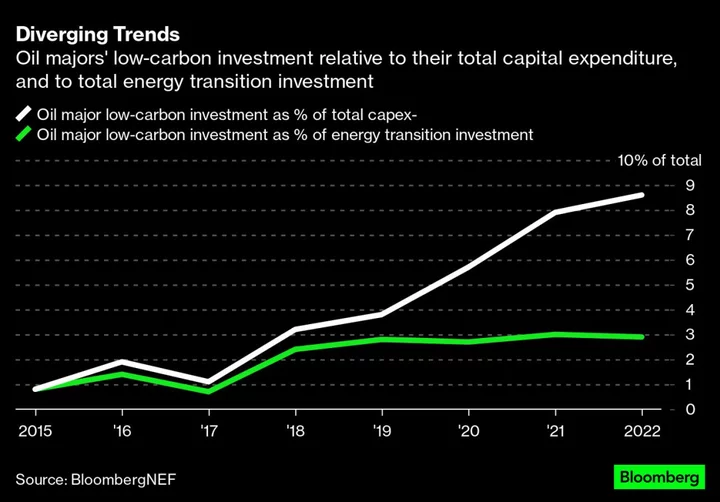

The company is increasing spending on clean energy projects and upgrading the chemical output of its refineries as China’s oil demand growth slows. That’s despite a target to cut annual capital expenditure by 11% to 243.5 billion yuan from last year.

Spending in the first nine months was 174.1 billion yuan, compared with 158 billion yuan in the same period last year.

PetroChina’s results complete a mixed bag for the nation’s oil giants. Sinopec last week posted a jump in third-quarter earnings, while Cnooc Ltd.’s profit dropped.

(Updates with more details after third paragraph.)