A solid employment report with stronger-than-expected wage growth for June keeps the Federal Reserve on track to raise interest rates this month and mull another hike as soon as September.

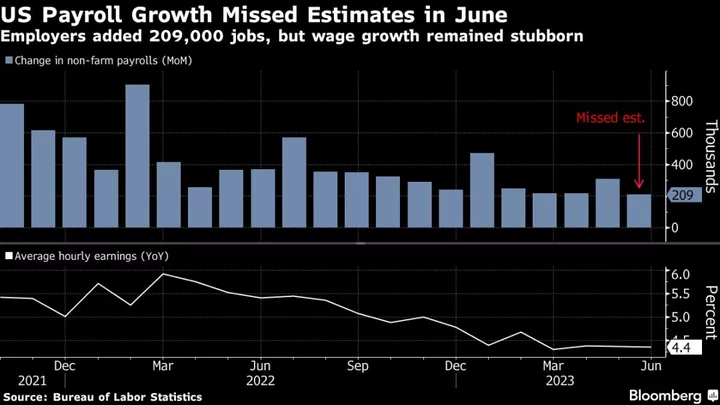

Nonfarm payrolls increased 209,000 last month, less than economists expected, and job gains over the prior two months were revised lower, a Bureau of Labor Statistics report showed Friday. The unemployment rate fell to 3.6%. Average hourly earnings rose 4.4% from a year earlier, and the average work week edged up.

“Clearly this is a green light for the July meeting,” said Vincent Reinhart, chief economist at Dreyfus and Mellon who previously spent a quarter century working at the Fed. “I think September’s an open question. There’s uncertainty about what they will do down the line.”

Almost all Federal Open Market Committee participants last month saw the need to raise rates further in light of persistent inflation and a tight labor market, according to minutes of their June 13-14 meeting released Wednesday. Traders maintained near-certainty that the Fed will hike at its July 25-26 gathering, while they had slightly less conviction for policymakers’ September and November meetings.

Read More: Fed Minutes Reveal Divisions Over Decision to Pause in June

Central bankers are likely to be particularly wary of signs of wage growth quickening, which some officials see as potentially feeding into higher prices that are inconsistent with their 2% inflation target.

“Wage pressures actually accelerated,” said Diane Swonk, chief economist at KPMG LLP in Chicago. “I still expect at least two hikes this year with this kind of momentum in the economy and these kinds of persistent wage gains.”

Fed Chair Jerome Powell last week it was appropriate to slow the pace of rate increases after a rapid ascent starting in March 2022, while not ruling out the possibility of hiking at consecutive meetings.

Policymakers have been projecting that the economy would slow to below its long-term trend and the unemployment rate would rise to 4.5% by next year, with slack in the job market easing price pressures. With the unemployment rate ticking down, this report showed the opposite happening.

“This is still a really strong report,” said Veronica Clark, an economist at Citigroup Inc., who is expecting July and September hikes. “They’ll probably care more about how wages picked up again and the unemployment rate, which is moving in the opposite direction of their forecast.”

What Bloomberg Economics Says...

“Even as clear cracks emerge — increasing part-time work, layoffs in select industries, and looming payroll revisions — the Fed will need to continue leaning against the labor market to sustainably rein in inflation. We expect the FOMC to raise the federal funds rate target by an additional 25 basis points at the July meeting.”

— Stuart Paul and Eliza Winger

To read the full note, click here

The committee will get one more key piece of data before the July meeting with the consumer price index report on July 12. That and future inflation reports will influence the course of rate hikes later this year.

“The focus of the Fed will be more on what actually happens to core inflation now,” said Dean Maki, chief economist at Point72 and a former Fed researcher. “I don’t think they’ll keep hiking just because the labor market’s strong. I think it would have to be a combination of the labor market remaining strong along with core inflation not moving in the way they want.”

The minutes of the past meeting showed the committee was divided in its decision, and the hawks pushed unsuccessfully for a quarter-point hike in June but agreed to support the pause with the entire committee coalescing around the idea they would tighten further later in the year.

The latest employment report is likely to reinforce those divisions. Officials who’d prefer to stay on hold can point to a significant moderation in payrolls given downward revisions from prior months, while those who want to tighten policy further can cite wage gains and falling unemployment.

“The choices that are creating some divisions in the committee now are just going to get worse,” Reinhart said.

(Adds Bloomberg Economics comment)