A world-beating rally in Chinese tech stocks this month is shoring up confidence that the once-beleaguered sector may finally see its fortunes reverse.

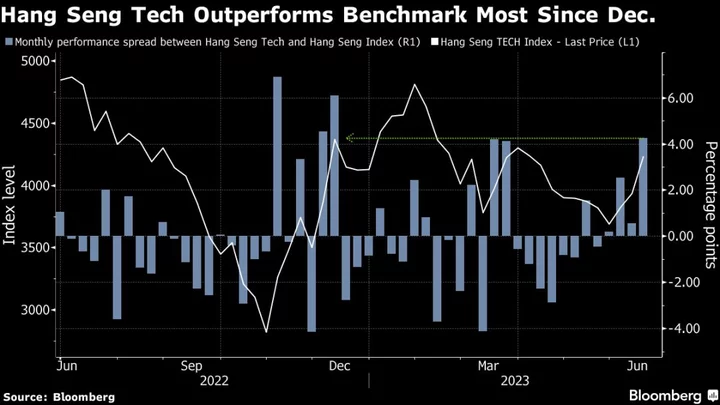

Not only are they besting shares in their own market — Hong Kong’s Hang Seng Tech Index outperformed the benchmark Hang Seng Index by the most since December last week — they’re also narrowing the gap with American rivals. The Nasdaq Golden Dragon China Index has beaten the broader Nasdaq Composite Index market for three consecutive weeks, the first time since January. Month-to-date, both the Hang Seng Tech and Nasdaq Golden Dragon gauges are up at least 15%, beating the majority of equity indexes tracked by Bloomberg.

There are a lot of reasons for the optimism. China tech shares are trading near the cheapest value relative to US peers on record in data back to 2006, while improving earnings are helping boost prospects. Stronger-than-expected sales data following a key shopping festival and easing US-China tensions are helping dispel concerns.

Xi Tells Blinken ‘Very Good’ Progress Made on US-China Ties

“On China tech stocks, they are inexpensive and a lot of bad news has been priced in,” write Redmond Wong, strategist at Saxo Capital Markets HK Ltd. “The recent bounce seems bargain-hunting as well as short-covering.”

It’s been a tough year for Chinese technology shares, weighed by a sluggish domestic economy. A frenzy in the artificial intelligence trade globally helped boost US technology companies more than Chinese firms, with investors disappointed by lackluster product launches. As a result, the price-to-earnings ratio of the Nasdaq Golden Dragon neared a record low versus the Nasdaq 100, according to data compiled by Bloomberg.

Many concerns ranging from the growth potential of these firms to the still-weak macro economy still remain. On a broader view, a number of Wall Street banks have started to cut their China Index targets in recent weeks. That could hurt tech stocks that often see a lot of froth and speculative buying.

But some changes are now underway. Over the weekend, China’s second-biggest online shopping event, called the 6.18 promotional festival, wrapped up with analysts citing better-than-expected data.

JD.com Inc. said the company’s sales during the event exceeded expectations, while Alibaba Group Holding Ltd. said the festival drew a record number of vendors and fast growth in daily users of short video. The earnings forecast for Alibaba and Tencent Holdings Ltd. have been revised up to the highest since 2021, data compiled by Bloomberg shows.

“China tech names were getting even cheaper after US tech’s AI rally in comparison,” said Xiadong Bao, fund manager at Edmond de Rothschild Asset Management, adding that the “618 shopping festival is having good data so far as well.”

That combination of data and events, combined with the cheap valuations, is encouraging some investors to take another look at the stocks that for the most part have been shunned.

”We have observed improving fundamentals of many large cap Chinese names in the HSTECH and Nasdaq Golden Dragon index. This includes better regulatory environment, better-than-expected quarterly results and improving profitability,” said Jian Shi Cortesi, a fund manager at Gam Investment Management. “However, their stock price performance has not reflected these improvements, due to very cautious investor sentiment.”

Top Tech Stories

- Softbank Group Corp.’s Masayoshi Son is due to make his first public appearance in seven months during the firm’s annual shareholder meeting on Wednesday, with cash-strapped startups wondering if the world’s biggest tech investor will ever go on the offensive again.

- Renault SA laid out financial goals for its electric vehicle arm Ampere — including breakeven on an operating basis as soon as 2025 — as it readies the division for an initial public offering.

- Four US lawmakers will travel to Detroit Tuesday to press the chief executives of Ford Motor Co. and General Motors Co. to cut their supply chains’ reliance on China, especially in electric-vehicle batteries. The trip highlights the domestic pressures the administration faces as it tries to patch up frayed ties with China.