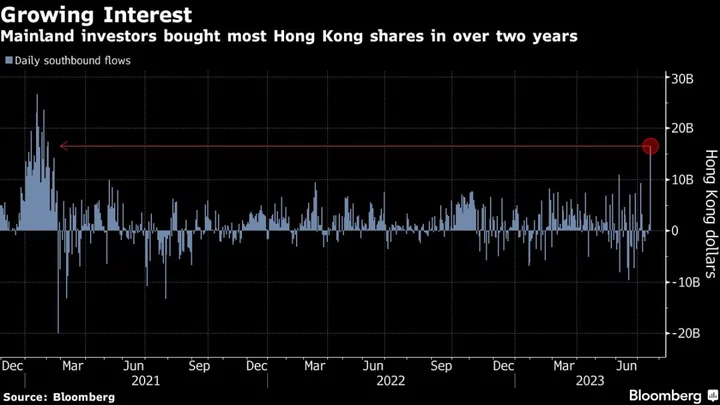

Mainland investors bought the most Hong Kong shares in almost two and a half years after the city’s key equity indexes slumped on mounting growth concerns and disappointment at Beijing’s pace of stimulus.

Interest in the financial hub’s equities from the mainland surged to the highest level since February 2021, with a net HK$16.5 billion ($2.1 billion) of Hong Kong shares purchased on Wednesday through the stock connect program. The inflows helped both the city’s benchmark Hang Seng Index and the Hang Seng China Enterprises gauge pare most of their earlier losses to end 0.3% lower.

Investor sentiment in Chinese equities remains weak as the nation’s second-quarter economic recovery missed expectations, prompting major Wall Street banks to downgrade their annual growth estimates. An ongoing property slump, reluctant Chinese consumers, a stubbornly high youth jobless rate, as well as Beijing’s limited support measures are contributing to the malaise.