Oil clawed back most of the previous day’s decline, as the Federal Reserve’s hawkish tone was weighed against expectations that looming OPEC+ supply cuts will tighten the market.

West Texas Intermediate futures traded near $69 a barrel on Thursday after falling 1.7% in the previous session. Fed officials paused in their run of interest-rate hikes but projected borrowing costs will go higher than previously expected to tame what Chair Jerome Powell called surprisingly persistent inflation. The outlook led to renewed worries that higher rates will push the US economy into a recession.

Meanwhile, just two weeks ahead Saudi Arabia’s pledge to bring in more output reductions, Middle Eastern oil is gaining in value relative to barrels supplied from the rest of the world. Whether that’s because the cuts are tightening the market has become hard to assess because of the highest level of trading activity for years in a key pricing window that sets the price of the region’s Dubai benchmark.

Crude in New York has lost almost 15% this year but drifted since early May as concerns over a US slowdown and a lackluster rebound in China’s economy wrestle with Saudi-led supply cuts. China’s apparent oil demand rose 17% last month from a year ago, while industrial output also edged higher, according to official data released on Thursday.

“Many think oil prices are low because demand is weak,” but data don’t support that theory, said Giovanni Staunovo. “Global visible oil inventories did not fall in the first four months of this year because supply growth was also solid.”

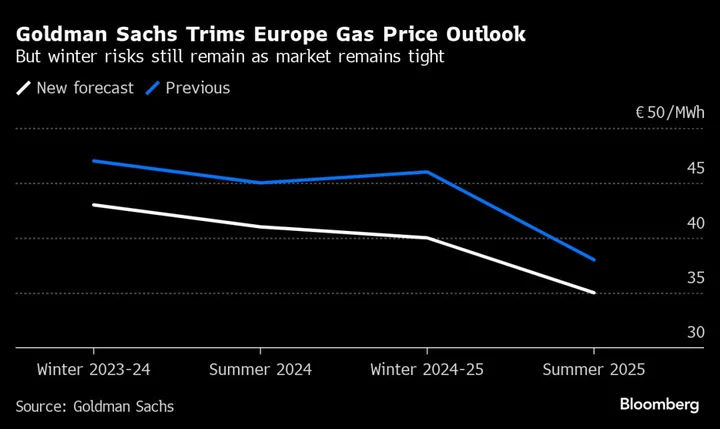

While there have been some bright spots for demand, the generally dour outlook has left Wall Street abandoning predictions for a sharply price rally this year. Both UBS and JPMorgan Chase & Co. have pulled back their price forecasts in recent days.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.