Oil climbed to its highest in almost nine months on concern that a possible escalation of the conflict between Russia and Ukraine may hamper supplies in an already tightening market.

West Texas Intermediate futures traded above $83 a barrel, breaking through an earlier high for the year set in April. There’s heightened focus on the risk to Russian flows from the Black Sea after President Volodymyr Zelenskiy said his country would retaliate to prevent the OPEC+ producer from “blocking our waters.” The remarks followed a Ukrainian drone attack on an oil tanker over the weekend.

“Continued risks to Russian crude shipments from tensions in the Black Sea remain,” said Ole Hansen, head of commodities strategy at Saxo Bank. “The underlying bullish narrative seems intact despite the dark clouds emerging over the Chinese economy.”

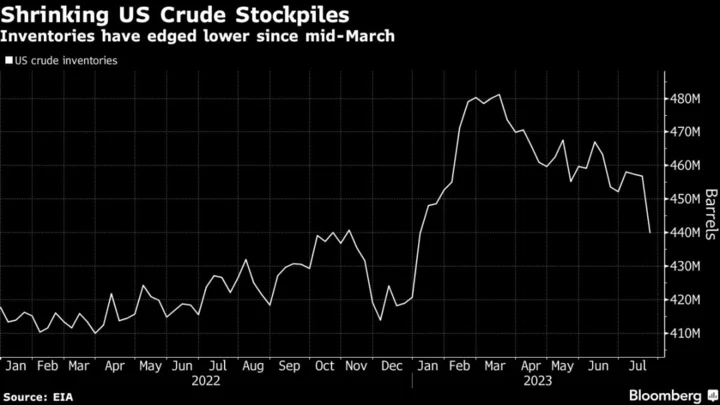

Key market gauges have been pointing to tighter markets in recent days. The nearest timespread for WTI crude closed at its strongest level since November on Tuesday. Stockpiles at the key storage hub of Cushing, Oklahoma have declined for five consecutive weeks.

The industry-funded American Petroleum Institute reported US crude stockpiles rose by 4.07 million barrels last week, according to people familiar. That would be the first gain in four weeks if confirmed by government data Wednesday.

Oil has rallied since late June following pledges by OPEC+ heavyweights Saudi Arabia and Russia to cut supply, but headwinds still linger. China’s economic rebound remains sluggish and the Energy Information Administration on Tuesday lowered its forecast for US consumption of products this year.

The International Energy Agency and OPEC will release reports later this week that will provide snapshots of the oil market, which is expected to tighten through the second half of the year.