Oil steadied as traders assessed the impact of the latest round of supply cuts from OPEC+ and a US industry report that pointed to another drawdown in nationwide commercial inventories.

West Texas Intermediate traded just below $72 a barrel, after rising by almost 3% over the previous two sessions following announcements from Saudi Arabia and Russia that they would cut production in a bid to stem a slide in prices.

The American Petroleum Institute estimated that nationwide US crude inventories declined by 4.4 million barrels last week, according to people familiar with the data. Official figures will follow later on Thursday, with stockpiles last reported at the lowest level in almost six months.

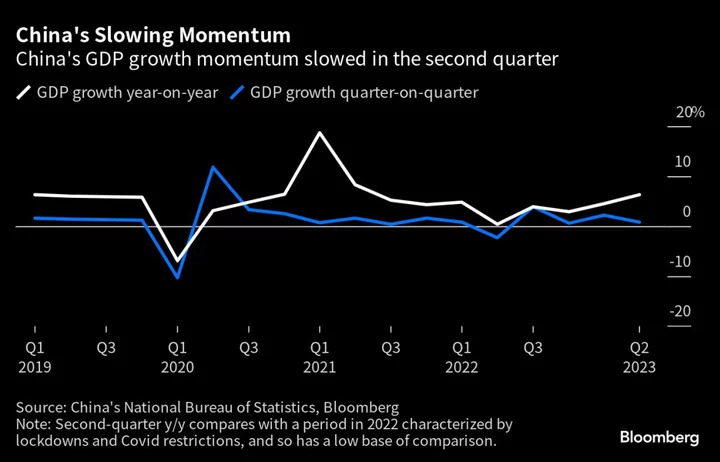

Crude remains about 10% lower this year, with China’s lackluster economic recovery and tighter monetary policy in the US and Europe weighing on the outlook for demand. The surge in borrowing costs is leading to lower global oil inventories, possibly setting prices up for spikes further down the line.

A large majority of US Federal Reserve officials agreed that more tightening will likely be needed this year, the minutes from the Fed’s latest meeting showed. Further hikes would aid the dollar, potentially making commodities priced in the currency less attractive. The greenback was flat on Thursday.

“Demand concerns were eased” with US stockpiles likely shrinking, said Charu Chanana, market strategist at Saxo Capital Markets Pte. in Singapore. “Focus will turn to the labor market indicators in the rest of the week,” she said, referring to US economic data.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.