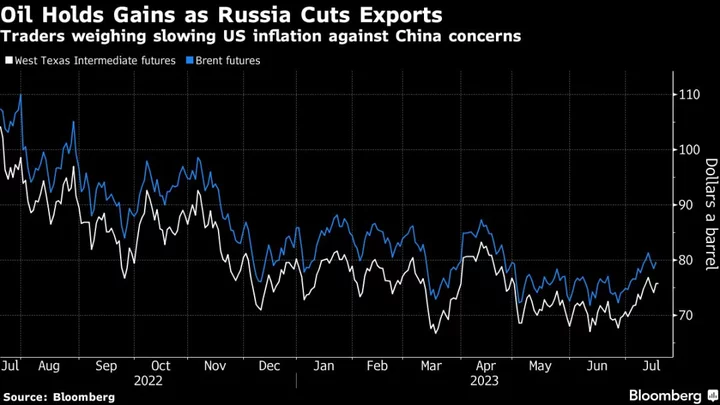

Oil edged lower as China’s lackluster recovery overshadowed a bullish outlook from the International Energy Agency and positive US data.

West Texas Intermediate futures traded below $71 a barrel after closing 0.4% lower on Tuesday. Some investment banks cut forecasts for China’s economic growth this year after weak April data, although the IEA remains upbeat on the Asian nation’s demand prospects following the end of Covid curbs.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.

Crude is down around 12% this year as China’s slower-than-expected recovery, a campaign of aggressive monetary tightening from the Federal Reserve, and more recent concerns over the US debt ceiling weigh on the outlook. Still, US retail sales rose in April, suggesting that consumer spending in the world’s biggest economy is holding up in the face of economic headwinds.

China’s poor manufacturing performance “may impede, if not chronically impair, prospects of restoration to pre-Covid strength,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. in Singapore. It should not be “dismissed as a passing headwind,” he added.

The industry-funded American Petroleum Institute reported US nationwide crude inventories rose by 3.69 million barrels last week, according to people familiar with the figures. Stockpiles at the oil storage hub at Cushing, Oklahoma, also expanded, while gasoline supplies shrank.