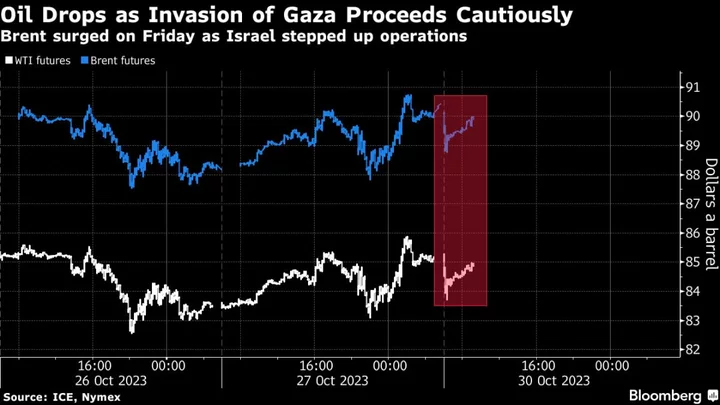

Oil fell after Israel committed military forces to Gaza with a more cautious approach than it initially vowed, bolstering speculation that the fighting may remain contained despite rhetoric from Iran.

Global benchmark Brent dropped below $90 a barrel, after rising by almost 3% on Friday as Israel stepped up operations, while West Texas Intermediate fell toward $84. While Israel has sent troops and tanks into the northern Gaza Strip in retaliation to the Oct. 7 attack, it’s taking a day-by-day approach instead of a massive invasion.

Oil markets have been transfixed by the conflict in Gaza on concerns that it could spread beyond the enclave and Israel. The Middle East accounts for a third of global crude supplies, and there are fears that an escalation of the war could lead to attacks on oil tankers, threats to maritime chokepoints, and a reduction in exports from Tehran.

Before crude futures began trading on Monday in Asia, both Tehran and Washington had warned that the conflict could still spread. Iran said the war may “force everyone to take action.” The US, meanwhile, saw an “elevated risk” of spillover, according to National Security Advisor Jake Sullivan.

“The weekend showed the armed conflict remains limited to Israel and Gaza — in that light, crude looked overbought,” said Vandana Hari, founder of consultancy Vanda Insights in Singapore. Prices will “likely continue sliding until the next risk event,” she said.

Iran is the main backer of Hamas, which has been designated as a terrorist group by the US and the European Union. Tehran also supports Hezbollah in southern Lebanon, which has forces positioned along Israel’s northern border and has the potential to open up a second front in the conflict.

Away from the Middle East, there have been mixed signs about the state of the physical market. In the US, stockpiles of oil held at the key storage hub at Cushing, Oklahoma, remain near the lowest level since 2014, but an unprecedented glut of gasoline has built up along the Gulf Coast.

Some market metrics point to less tight conditions. WTI’s prompt spread — the difference between its two nearest contracts — was 77 cents a barrel in backwardation. That’s still a bullish pattern, but it’s still near the lows seen last week, and less than before the conflict erupted.

Terminal users can click here for more on the Israel-Hamas War.