Oil declined, tracking losses in wider equity markets, as Israel held off on its ground invasion of Gaza amid diplomatic efforts to secure the release of more hostages.

Global benchmark Brent dipped below $92 a barrel and West Texas Intermediate traded near $87 after two straight weeks of gains. Israel warned that Iran-backed Hezbollah risked dragging neighboring Lebanon into the war even as it continued fierce air raids on Hamas in Gaza. More than 60,000 people in Israel have been evacuated along the border with Lebanon.

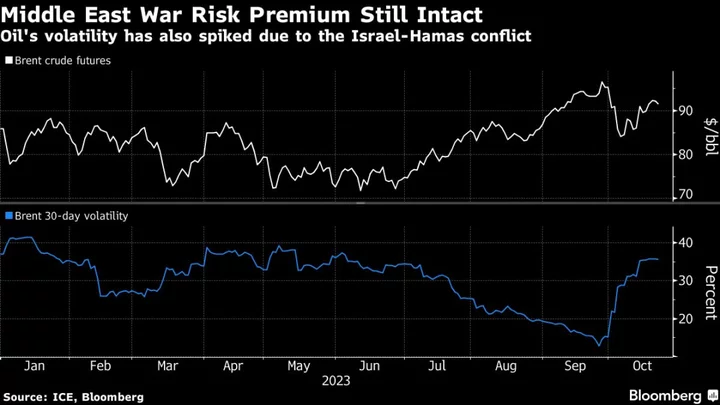

Brent has advanced about 8% since the Oct. 7 attack on Israel by Hamas on concerns the conflict will drag in other nations including Lebanon, Iran and potentially the US. The Middle East supplies around a third of the world’s crude and the main risks for the market are that Washington ramps up compliance checks on sanctioned Iranian oil and that Tehran disrupts key shipping routes.

A widely expected ground offensive by Israel into the Gaza Strip was delayed — due to pressure from US and European governments — in order to buy time for efforts to secure the release of hostages held by Hamas, designated a terrorist group by the US and the European Union. An American mother and her daughter were released on Friday through the mediation of Qatar.

Oil is “taking a breather while the focus on humanitarian aid and securing hostage releases suggest that a potential ground invasion from Israel can wait,” said Yeap Jun Rong, market strategist at IG Asia Pte. “That may contain the risks of further escalation, at least for now.”

Oil traders have increased their bullish positioning due to the war, with hedge funds boosting their combined bets in the week ended Oct. 17 that Brent and WTI will rise, according to exchange data released Friday. Crude’s volatility also spiked last week.

The Middle East war-risk premium may be partially offset by the prospect of more Venezuelan crude exports after the US last week took the first steps in pulling back on its sanctions policy. The likes of Chevron Corp., Rosneft PJSC and Repsol SA are poised to benefit from the reopening.

Terminal users can click here for more on the Israel-Hamas War.

--With assistance from Serene Cheong.