Oil climbed as investors weighed the fallout from an attempted mutiny in Russia against Vladimir Putin’s almost quarter-century rule, while concerns over a global slowdown remained.

West Texas Intermediate rose in Asia after ending the prior week almost 4% lower. Global benchmark Brent climbed. An eerie calm fell on Russia after the dramatic end to an uprising by troops loyal to mercenary Yevgeny Prigozhin, though the instability could reverberate further.

“The internal military struggle in Russia adds limited oil price pressure amid heightened tensions in Moscow,” Rystad Energy Senior Vice President Jorge Leon wrote in a note. “We do, however, believe that the geopolitical risk amid internal instability in Russia has increased.”

Elsewhere, markets are showing recessionary signals, replacing the previous panic over inflation as investors come to terms with an increasingly tight monetary policy and its threat to economic growth, especially in Europe.

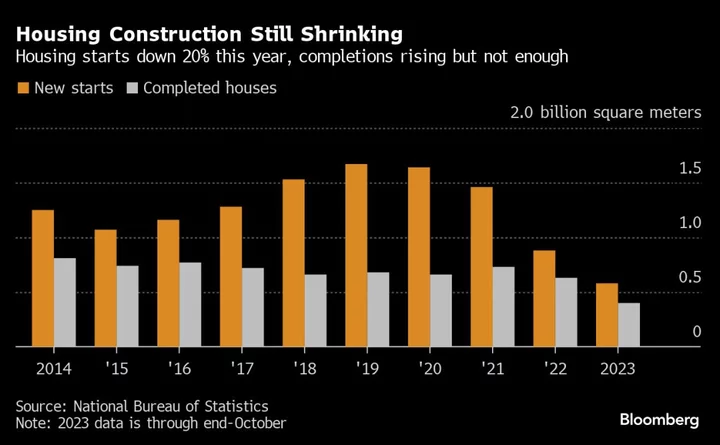

Oil in New York is around 13% lower this year, as the Federal Reserve’s aggressive monetary tightening campaign and China’s lackluster recovery weighed on the demand outlook. Resilient Russian production, even in the face of Western sanctions, has also contributed to the price pressures.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.