Nvidia Corp., the world’s most valuable chipmaker, forecast sales that blew past analysts estimates, showing how booming demand for artificial intelligence processors has the potential to reshape the sector and setting shares up to hit a record high.

Sales in the three months ending in July will be about $11 billion, Santa Clara, California-based Nvidia said Wednesday. That shattered an average analyst estimate of $7.18 billion.

Read More: Nvidia Soars After Flagging AI Demand, Eyes $1 Trillion Value

“We’re seeing incredible orders to retool the world’s data centers,” Chief Executive Officer and co-founder Jensen Huang told analysts on a conference call. A trillion dollars of data center infrastructure will be upgraded to handle so-called accelerated computing, he said, letting them run generative AI tools such as ChatGPT. “The budget of a data center will shift very strongly to accelerated computing.”

Shares rose about 25% in premarket trading before New York exchanges opened on Thursday. The after-market surge also helped lift stocks of other chipmakers and AI-related companies, including ASML Holding NV and Advanced Micro Devices Inc. Shares of Nvidia had closed at $305.38 Wednesday before the results were released.

The outlook shows that Nvidia is benefiting even more from the AI frenzy than thought possible. Under Huang, the company has positioned itself as the top provider of components for training artificial intelligence software. That’s helped it weather a broader slowdown in technology spending.

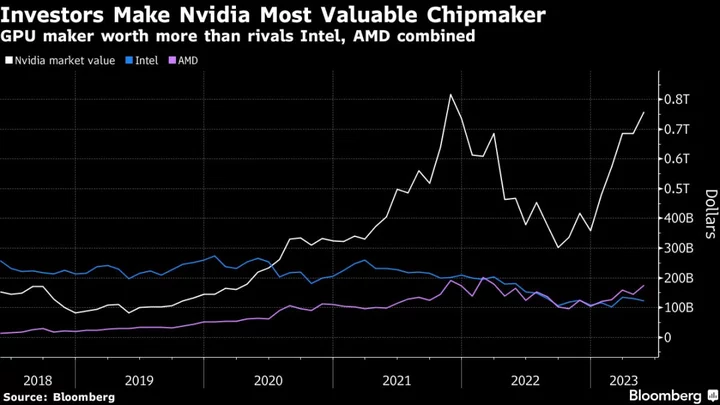

Already, Nvidia had outperformed stocks in the major indexes it trades on this year, turning it into the world’s fifth-largest publicly traded company. Nvidia’s market value had swelled to $755 billion by Wednesday’s close. By that measure, the chipmaker is more than six times the size of Intel Corp., a company that had more than twice Nvidia’s annual revenue last year.

Revenue in the first quarter beat estimates by the widest margin in five years. And the company’s forecast for sales this period is 53% higher than analysts projected, marking a record quarterly total.

“They may be in a unique position,” Sanford C. Bernstein analyst Stacy Rasgon said on Bloomberg Television. While the company doesn’t project individual unit revenue, the overall forecast implies a 75% surge in data center revenue, he said. “Is it a one-time thing or is this the new normal? I don’t know.”

Investors have singled out Nvidia as one of the big potential winners in AI, following the viral success of the ChatGPT chatbot and other popular tools. The company’s chips excel at parallel processing, which makes them well suited for training software by bombarding it with data.

The growth also suggests that Nvidia is getting adequate supplies from manufacturing partners such as Taiwan Semiconductor Manufacturing Co. Nvidia Chief Financial Officer Colette Kress said the company has secured a “substantial” increase in supply of AI-related chips from its subcontractors for the second half of the year.

Nvidia’s Huang argued that the use of the technology is only in its infancy and more tailored products for specific industries are needed. He’s built online services and software tools to help encourage the broader adoption of AI outside of his big customers — cloud providers like Microsoft Corp. and Amazon.com Inc.’s AWS.

As part of its second-quarter forecast, Nvidia predicted an adjusted gross margin of about 70%, above the 66.9% analysts were projecting.

The AI spending surge has boosted Nvidia’s data center unit, though a collapse in demand for personal computer components is still hammering its graphics chip business — and weighing on overall sales.

In the fiscal first quarter, which ended April 30, revenue fell 13% to $7.19 billion. That marked a second consecutive decline of more than 10%, but it was a smaller decrease than projected. Profit was $1.09 a share, minus certain items. Analysts had predicted earnings of 92 cents and sales of about $6.5 billion.

The company’s graphics business — heavily reliant on a PC industry that’s been awash with too much inventory — had revenue of $2.24 billion last quarter, a decline of 38%. That compares with an average estimate of $1.89 billion. Data center sales grew 14% to $4.28 billion, versus an average prediction of $3.9 billion.

Nvidia said revenue growth in its data center unit was driven by “strong demand from large consumer internet companies and cloud service providers.” Those customers are deploying its graphics chips to power generative AI and large language models, the company said.

Gaming-related revenue improved sequentially, helped by demand for Nvidia’s latest GeForce RTX 40 series products, the Santa Clara, California-based company said.