A peek at five often overlooked raw materials markets shows how China’s stuttering recovery extends to almost every nook and cranny of its economy.

Commodities like crude oil or copper usually take the headlines for investors parsing the state of Chinese demand. But the world’s second-biggest economy also hosts an array of markets that trade less familiar products. While they may not attract Wall Street analysis, they’re still recognizable as important building blocks of an economy.

Futures markets for items as diverse as glass, styrene and corn starch are piling on the evidence that China isn’t recovering as fast as many people had hoped, after Beijing abandoned the pandemic restrictions late last year that were crushing its economy.

Glass

China accounts for more than half of the world’s plate glass production thanks to the rapid growth of high-rise buildings and vehicle sales in recent decades. Similar to other industries, low margins and supply gluts have troubled producers for years, forcing them to cut output in recent months.

The situation this year looks even more challenging. Glass futures on the Zhengzhou Commodity Exchange have plunged nearly 20% in the past month, a period when demand usually picks up. The reasons include China’s teetering property market and weaker-than-expected vehicle output in April.

Trucked LNG

China has a vast requirement for natural gas, carried by sea from mega-projects in far-flung places like Qatar and Australia, or over pipelines that stretch across continental Asia. But the last few miles to consumers is often via trucks that criss-cross China’s cities, a barometer of the immediate needs of industries from glass-makers to ceramic factories.

That price has fallen to its lowest level in almost two years. Demand is so weak that the nation’s top importers of seaborne liquefied natural gas are even offering to resell their shipments abroad.

Styrene

Fewer home buyers also means less demand for the purchases that often accompany a new place to live. The price of styrene monomer, a material used for the plastics and rubber that go into appliances like fridges, has declined. China has been the world’s fastest growing market in the past decade with capacity climbing to over 40% of the global total.

Dalian futures fell last week to their lowest since February 2021, after a near-5% drop in home appliance sales in the first quarter, according to the National Appliance Information Center. The problems are slower growth in personal incomes and a “low-frequency sales cycle” for white goods, according to Wu Haitao, a director at the center.

Corn Starch

Corn starch has a wide variety of uses, in soft drinks, as a thickening agent for sauces and in the paper and textiles industries. China produces almost 50 million tons a year.

Although retail sales have outperformed other economic measurements in the months since China’s Covid Zero restrictions were lifted, they grew at a slower pace than expected in April. China’s falling population is another headwind: corn starch is a key ingredient in baby formula.

Paper Pulp

Shanghai pulp futures went into free-fall in February after a sudden recovery in production at paper mills after the Lunar New Year holiday was augmented by resurgent imports. Domestic demand, which was also supposed to rise after China’s reopening, couldn’t keep up.

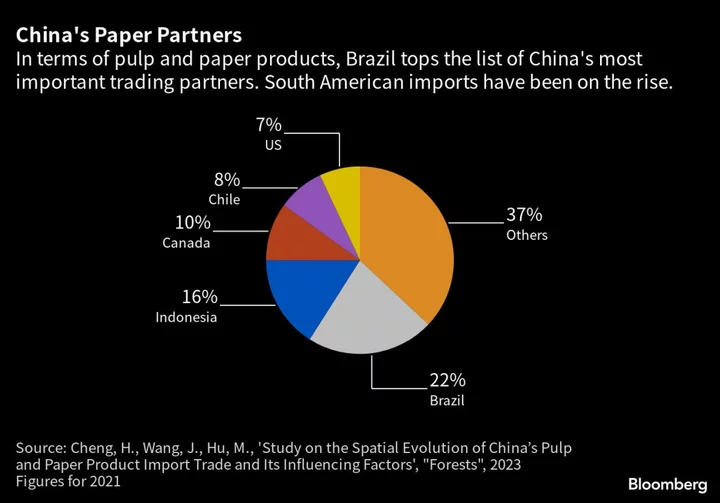

As with many commodities, China is the biggest producer and consumer of pulp, used for packaging, publishing and household goods. But the market is so vast that a lot of pulp and paper also needs to be sourced from abroad.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Tuesday, May 30

- SMM Indonesia Nickel and Cobalt Industry Chain Conference in Jakarta, day 1

Wednesday, May 31

- China official PMIs for May, 09:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

- SMM Indonesia Nickel and Cobalt Industry Chain Conference in Jakarta, day 2

Thursday, June 1

- Caixin’s China manufacturing PMI for May, 09:45

Friday, June 2

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

--With assistance from Hallie Gu, Stephen Stapczynski, Kathy Chen and Dan Murtaugh.

(Updates with diary items in final section)