Morgan Stanley has pushed back against Treasury bears, saying investors should buy US sovereign debt as markets may be too optimistic over the prospect of a soft-landing for the economy.

Treasuries are also likely to be supported as inflation can keep slowing even if growth does remain relatively healthy, strategists at the investment bank including Matthew Hornbach in New York wrote in a research note.

“We continue to suggest investors adopt an overweight stance on government bond duration,” the strategists said. “Market extrapolation of strong growth into the long term via higher long-term real rates may not pan out, leaving the rise in long-end yields vulnerable to a correction.”

The investment bank is advising its clients buy Treasury five-year notes and 30-year inflation-linked debt, according to the note.

Morgan Stanley’s bullish view clashes with a number of its Wall Street peers.

JPMorgan Chase & Co. raised its forecasts for Treasury yields last week — increasing the year-end target for the 10-year to 4.20% from 3.85%, and ended a losing recommendation to be long five-year notes. Bank of America also last week recommended its clients to take a neutral stance on US debt, saying economic resilience may cause 10-year yields to climb as high as 4.75% before settling around 4%.

The latest market positioning data echoes the Wall Street conflict. Asset managers were bullish on 10-year Treasury futures in the latest weekly figures from the Commodity Futures Trading Commission, while hedge funds extended bearish positioning in long-bond contracts.

Feeling Good

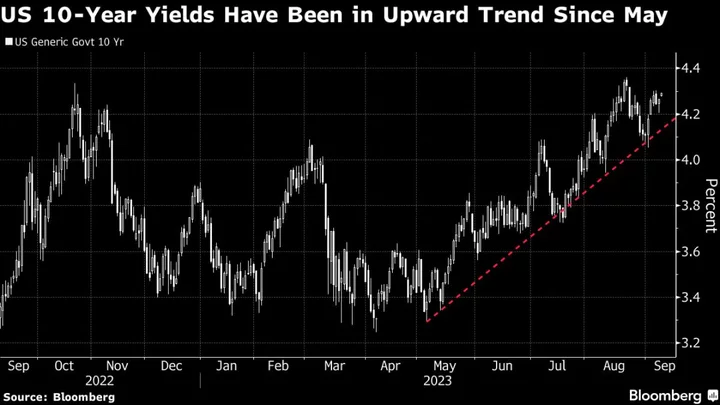

Benchmark US yields have climbed about a percentage point from this year’s low set in April as traders scrapped bets on Federal Reserve interest-rate cuts this year due to better-than-expected economic data. Ten-year yields rose another three basis points to 4.29% Monday after Treasury Secretary Janet Yellen said on Sunday she’s “feeling very good” about avoiding a recession and containing inflation.

For its part, Morgan Stanley is happy to stand out from the crowd.

“They say it’s lonely at the top,” the strategists wrote. “The same can be said for being bullish on bonds at the highs in yield. We stand alone, with conviction, telling investors to buy government bonds.”