Mexico’s annual inflation sped up roughly in line with expectations in early November as central bankers begin to hint that they could kick off a monetary easing cycle in the coming months.

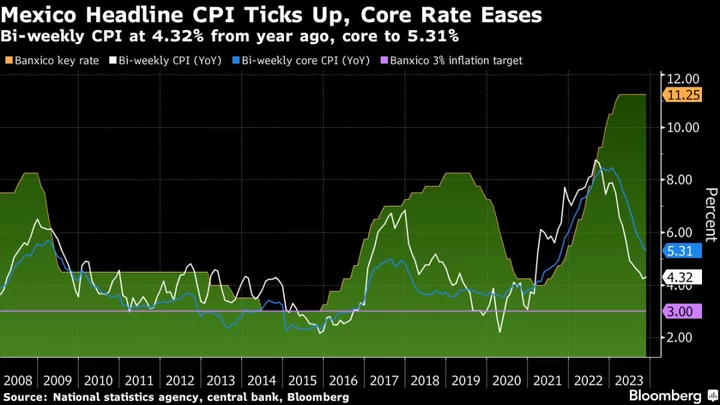

Consumer prices rose 4.32% in the first half of the month compared to the same period a year earlier, up from 4.25% in late October, the national statistics institute reported Thursday. The print was just above the median estimate of 4.29% from analysts in a Bloomberg survey.

Core inflation, which is closely watched by the central bank and strips out volatile items like food and fuel, slowed to 5.31%, roughly in line with the 5.33% forecast.

Banxico, as the nation’s central bank is known, held its benchmark interest rate at 11.25% earlier this month, the highest level since it began targeting inflation in 2008. But policymakers acknowledged that progress had been made in their fight against consumer price increases, opening the door to an eventual reduction in borrowing costs.

Read more: Mexico Signals Forthcoming Cut After Keeping Rate Unchanged

Even with tight monetary policy, growth in Latin America’s second-largest economy has proven resilient, thanks to a strong labor market and trade to the US. Still, consumer demand is beginning to cool.

Annual consumer price growth remains above Banxico’s target of 3%, plus or minus 1 percentage point, but inflation is expected to moderate in coming months from the drag of double-digit borrowing costs.

--With assistance from Rafael Gayol and Giovanna Serafim.