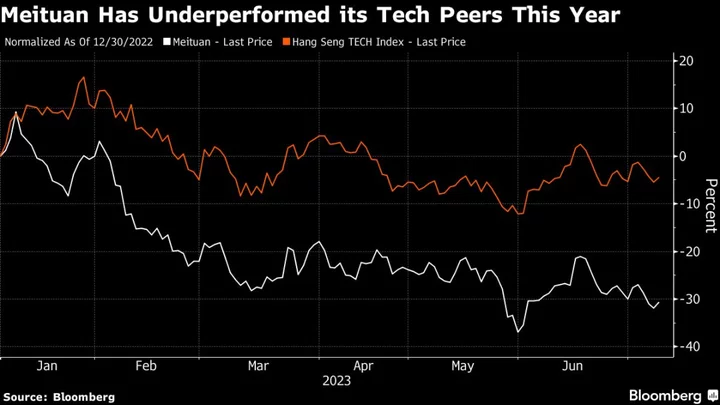

Meituan’s 30% slide this year shows that troubles are deepening for the Chinese food-delivery firm as it faces stiff competition trying to keep market share away from rival ByteDance Ltd.

The tech-driven company is facing an increasing challenge from ByteDance — owner of TikTok Inc. — which aims to seize a greater share of Meituan’s retail business via Douyin, a short video platform that also has built-in e-commerce features. Bytedance is also moving into Meituan’s key and profitable food-delivery sector.

That spells concern for the Chinese tech firm that is currently the fifth-worst performer on the 30-member Hang Seng Tech Index this year. Through Monday’s close in Hong Kong, Meituan’s decline was more than six times that of the tech gauge and it has slumped about three quarters from a record high close set in February 2021.

“Meituan guided for much lower margins to fight off Douyin, and until they change that guidance, or their results show much better margins, there is no reason for investors to change their view,” said Vey-Sern Ling, managing director at Union Bancaire Privee in Singapore.

One battleground between Meituan and Bytedance is over their so-called in-store business, where the companies charge merchants who issue coupons, vouchers, tickets and accommodation reservations on their platforms.

The next few months may be particularly decisive in the battle between the two firms given they are traditional peak season for hotels and travel, said Jialong Shi, an analyst at Nomura International HK Ltd. in Hong Kong. “It will be a very crucial period to watch, because summer is a big time for local services.”

Difficult Year

It’s been a challenging year for e-commerce companies in China given the highly anticipated revenge-spending trade has fizzled on the back of a stuttering economy. The disappointment has compelled some firms to offer deep price cuts amid tough competition. Meituan has suffered particularly hard as unlike online-gaming firms, its food-delivery business has a slim margin and low entry barrier.

To fend off ByteDance, Meituan earlier this year announced plans to hire as many as 10,000 staff. The decision was met with resistance from investors, who were concerned about margins being hurt.

Read more: China Tech Giant Meituan Hires 10,000 to Counter ByteDance

Meituan’s revenue jumped a larger-than-expected 27% in the first quarter, due to rising demand for meal deliveries and travel. The company said its in-store business accelerated in the first quarter after adjusting its subsidy strategy.

It’s not all looking bad for Meituan. The company may be able to sustain its lead thanks to the improved operating environment for its in-store business after the Covid lockdowns as well as its heavy subsidies, Nomura’s Shi said.

The stock has 59 buy ratings, 2 holds and just one sell, and analysts expect 63% upside over the next 12 months, according to data compiled by Bloomberg,

Loss Making

Still, analysts have many questions that remain unanswered. Meituan seems too committed to its loss-making community group buying platform, where a number of buyers can purchase products together to fetch deeper discounts. There’s also uncertainty over how the firm will embed AI technology into its current operations after buying artificial-general-intelligence innovator Light Year last month.

While it may take some time for newcomer Douyin to replicate Meituan’s platform, the food delivery business’s growth has slowed “considerably,” said Kai Wang, an analyst at Morningstar Inc. in Hong Kong, adding that Meituan has been “burning a lot of cash in their new initiatives.”

“Their in-store business margins are going down faster than expected,” said Wang. “Douyin is going to take a long time to kind of replicate Meituan’s platform, but it’s not impossible for them to do it.”

Tech Chart of the Day

Shares of Meta Platforms Inc. have been on a tear in recent months, more than tripling from their November low. However, the stock that suffered the biggest-ever one-day loss of market value has yet to recoup losses incurred since that fateful day. The Facebook and Instagram parent plunged 26% on Feb. 3, 2022, on the back of woeful earnings results, erasing a record $251 billion in market value. The stock, which is still 9.5% below the close before the market tumble, was edging higher on Tuesday.

Top Tech Stories

- Meta’s answer to Twitter has rocketed to 100 million users in less than a week, Chief Executive Officer Mark Zuckerberg announced on Monday.

- Uber Technologies Inc. Chief Financial Officer Nelson Chai is planning to leave the ride-hailing company, according to people familiar with the matter, marking the most significant executive departure since the company went public in 2019.

- An artificial intelligence researcher who co-authored one of Google’s most influential papers in the field is leaving the company to launch a startup.

- Tata Group, India’s largest conglomerate, is close to an agreement to acquire an Apple Inc. supplier’s factory as soon as August, marking the first time a local company would move into the assembly of iPhones, according to people familiar with the matter.

- Asian semiconductor sector stocks gain after TSMC reported better-than-expected sales, helped by the AI boom, and US peers climbed Monday.

- Sumco Corp. shares saw their biggest intraday jump in 17 months after a Nikkei report said the company will receive a ¥75 billion ($532 million) subsidy from the Japanese government for new factories.

- ASML Holding NV plans to slow hiring this year amid a downturn in the chip industry and after it enrolled 10,000 employees in 2022.

--With assistance from Subrat Patnaik.

(Updates to add stock move in the Tech Chart of the Day section.)