A look at the day ahead in European and global markets from Ankur Banerjee

The "will-they-won't-they" discussion over yen intervention has now morphed to "did-they-didn't-they" speculation, after the Japanese currency briefly breached 150 per dollar in U.S. trade and then abruptly reversed course, strengthening to 147.30.

Tokyo has not confirmed any such move to support the yen, with both Japan's finance minister and its top currency diplomat making no direct comment.

Tokyo last intervened to buy yen in September and October last year, when the currency eventually slumped to a 32-year low of 151.94 per dollar. In Asian hours, the yen was back just below the 150 mark and last at 149.27 per dollar.

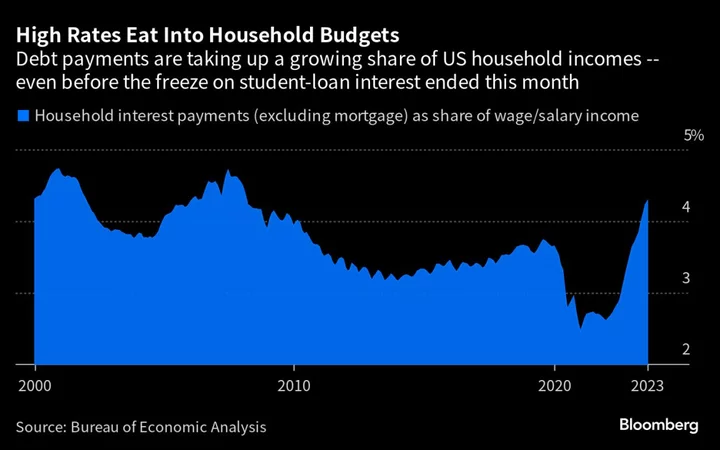

The global bond selloff shows no signs of slowing as investors come to terms with a new era of higher-for-longer interest rates. They continue to sell bonds, sending yields higher with the 10-year Treasury yield at a fresh 16 year peak. The benchmark 10-year Japanese government bond yield also clung to a 10-year high.

It all makes for a yet another risk-averse and jittery European session, with futures indicating a lower open.

Investor attention will also be on the political drama playing out in the United States, where a handful of Republicans in the U.S. House of Representatives on Tuesday ousted Republican Speaker Kevin McCarthy.

Meanwhile, British media regulator Ofcom will this week push for an antitrust investigation into Amazon and Microsoft's dominance of Britain's cloud computing market, two sources familiar with the matter told Reuters.

In corporate news, Meta is planning to lay off employees on Wednesday in the unit of its metaverse-oriented Reality Labs division focused on creating custom silicon, two sources familiar with the matter told Reuters on Tuesday. Reuters was not able to determine the extent of the cuts.

Key developments that could influence markets on Wednesday:

-September service PMI for euro zone, Germany, France, Italy, UK, and U.S.

-Euro zone August PPI, retail sales

-U.S. August factory orders

(Reporting by Ankur Banerjee; Editing by Edmund Klamann)