By Jamie McGeever

A look at the day ahead in Asian markets from Jamie McGeever, financial markets columnist.

The Bank of Japan on Friday rounds off one of the most intense weeks in recent memory for central bank policy decisions, with global markets still reverberating from the shockwaves that have followed the Federal Reserve's 'hawkish pause' on Wednesday.

World stocks and risk assets tumbled for a second day on Thursday and U.S. bond yields soared to fresh multi-year highs, as investors adjusted to the Fed's revised rate outlook that hammered home its 'higher for longer' stance on interest rates.

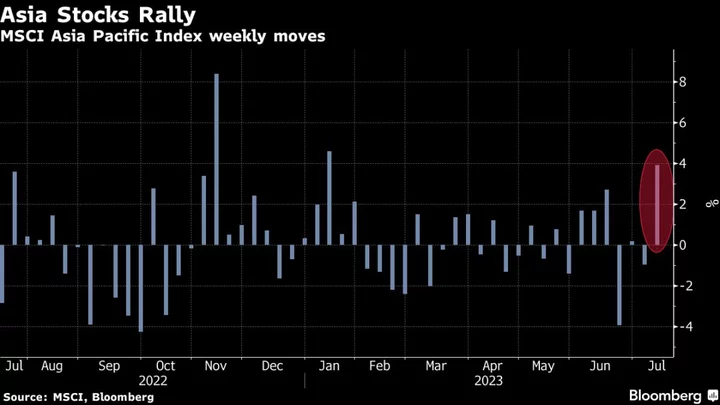

MSCI's World Index plunged 1.5% for its biggest fall in six weeks, and its fifth decline in a row marked its worst run since March. MSCI's Asia ex-Japan index also had its worst day since early August, and Wall Street slumped to a three-month low.

In a sign of how much the landscape is shifting HSBC's fixed income research team led by Steven Major - one of the strongest advocates of a 'lower for longer' view on rates and yields - raised its U.S. Treasury yield forecasts on Thursday.

Further complicating the picture for investors, however, were the surprisingly dovish decisions from the Bank of England and Swiss National Bank. Both kept rates on hold on Thursday, confounding expectations they would both hike.

All eyes now turn to the BOJ.

None of the 26 economists polled by Reuters expect any change to its easy stance on Friday but nearly 80% of them said the central bank will also abolish the 10-year yield control scheme by the end of 2024. More than half reckon negative interest rate policy will end next year too.

The fog of uncertainty, and pull of opposing domestic and global forces, continue to hold sway over Japanese assets.

The 10-year Japanese Government Bond yield hit a 10-year high of 0.75% on Thursday, and while the yen rebounded too, it did so from a new 2023 low of 148.45 per dollar earlier in the day.

Speculation that Tokyo will intervene in the FX market to support the yen is unlikely to cool. Prime Minister Fumio Kishida said on Thursday that no option is ruled out in addressing "excessive volatility", adding that "authorities are in close communication internationally."

While the BOJ's meeting is the marquee event in Asia on Friday, there is a raft of other indicators that could give local markets a steer, including the latest inflation data from Japan and Malaysia, and New Zealand trade figures.

The first purchasing managers index reports for September begin filtering out on Friday, starting with Australia and Japan, then Germany, France and Britain later in the day.

Here are key developments that could provide more direction to markets on Friday:

- Bank of Japan policy meeting

- Japan inflation (August)

- Japan, Australia PMIs (September)

(By Jamie McGeever; Editing by Josie Kao)