By Jamie McGeever

A look at the day ahead in Asian markets from Jamie McGeever, financial markets columnist.

The week ahead could be pivotal to the financial market landscape for the rest of the year, as the G3 central banks deliver their latest policy decisions and China's Politburo of the ruling Communist Party meets to discuss the economy.

The U.S. Federal Reserve, European Central Bank and Bank of Japan decisions and press conferences all come over the Wednesday-Friday 48-hour period, and China's Politburo is expected to begin its meet on Friday.

If that wasn't enough, purchasing managers index figures will give the first indications on how economies performed in July. The U.S. earnings season moves up a gear with Meta Platforms, Microsoft and Alphabet among the big names reporting.

Dovish signals from Fed Chair Jerome Powell would probably boost risk appetite and lift global stocks markets. The dollar and U.S. bond yields would likely come under downward pressure too - often bullish triggers for Asian and emerging markets.

Investors in Asia have to wait until Friday for the big two set pieces of the week.

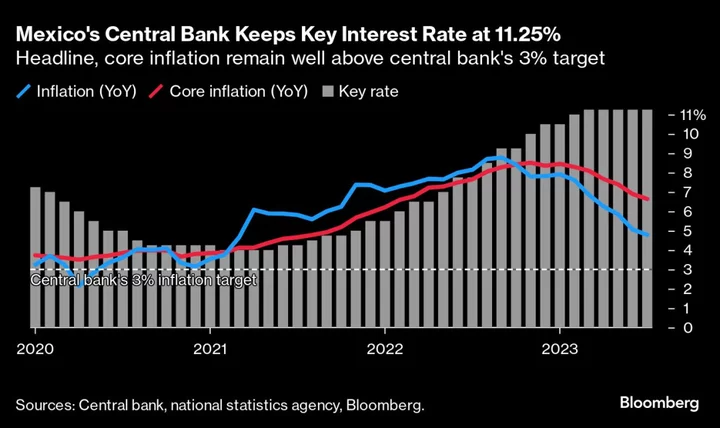

More than three quarters of economists polled by Reuters expect the BOJ to keep policy unchanged, including its yield control scheme. BOJ Governor Kazuo Ueda has signaled his resolve to maintain massive monetary stimulus, despite inflation persistently outpacing the bank's 2% target.

In a symbolic development last week, Japan's annual rate of headline consumer inflation rose above comparable U.S. inflation for the first time since 2015. But the BOJ's deflation battle scars run deep, so investor hopes of and end to super-loose policy are being pushed back further.

It's a different story in China - the economy and markets are badly underperforming, growth forecasts are being slashed, and the big danger is deflation, not inflation.

The central bank has been reluctant to ease policy because the already weak yuan could come under even greater selling pressure, so investors are pinning their hopes on a fiscal boost from Beijing. And it will have to be a significant boost.

Measures announced on Friday to help boost sales of cars and electronics failed to impress investors, and foreigners are steering clear of China's financial assets even though they are relatively cheap.

But the economic, financial, political and social challenges Beijing faces are such that Chinese stocks can get even cheaper before foreign investors start buying again en masse.

Monday's economic data calendar and potential market-movers in Asia will be the Japanese and Australian PMIs, and the latest inflation figures from Malaysia and Singapore.

Malaysian inflation is expected to fall to 2.4% in June - the lowest since April last year - from 2.8% in May. Singapore's inflation is seen falling to 4.55% - the lowest since February last year - from 5.10%.

Here are key developments that could provide more direction to markets on Monday:

- Japan PMIs (July)

- Australia PMIs (July)

- Singapore inflation (June)

(By Jamie McGeever; Editing by Diane Craft)