Litecoin, the world’s 11th-biggest cryptocurrency, saw its price slide on Wednesday after it went through a so-called halvening, with the rewards paid to computers supporting its network dropping in half. Don’t expect the same outcome next year when Bitcoin’s own halvening is due.

Litecoin is an offshoot of Bitcoin and their halvenings, designed to reduce the amount of new coin supply entering circulation, occur about every four years. In Litecoin’s process, rewards received by computers supporting its network, called miners, have dropped to 6.25 Litecoins from 12.5. Bitcoin’s halvening is expected next spring.

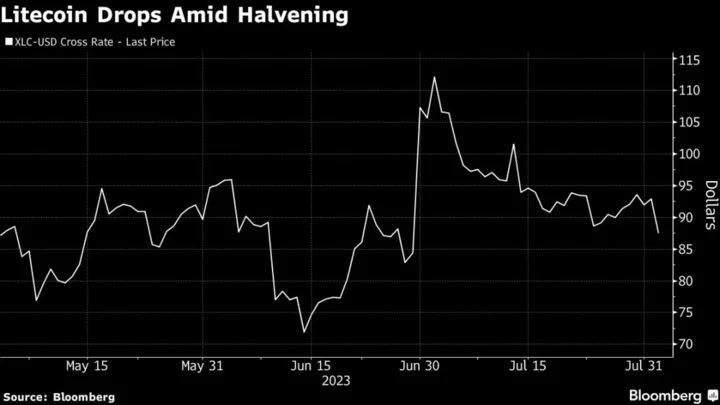

Litecoin has behaved differently than Bitcoin during these events. Litecoin’s price had dropped for months after each of its prior two halvenings, and it fell 5.7% on Wednesday. The token’s price climbed about 60% between January and early July, to more than $112, before sliding back to $87.62 currently. But many digital currencies rallied during that time. Bitcoin has jumped 77% this year.

The world’s biggest cryptocurrency tends to see a big price impact from its halvenings. Bitcoin’s price had typically rallied beforehand, and often after as well. For example, after the May 2020 event, Bitcoin’s price rose about sevenfold in the following year before dropping sharply.

Read more: Bitcoin Bulls Take Heart From Litecoin’s Market-Beating Jump

Bitcoin has also gotten a lift more recently from news of BlackRock Inc., the world’s biggest asset manager, filing for a Bitcoin exchange-traded fund in June.

“Long LTC was somewhat of a crowded trade at the beginning of the year when the narrative was in focus,” said Kyle Doane, a trader at Arca. “Since then, the LTC narrative faded as the market shifted focus to the slew of spot BTC ETF applications.”